Introduction: Conformance with Consequence

Compliance doesn’t fail loudly. It erodes quietly.

A missed attestation. An outdated policy. A vendor with unverified controls. The problem isn’t that organizations don’t care about compliance — it’s that they manage it like paperwork, not governance. And that mistake doesn’t just lead to fines or audit findings. It fractures trust. It slows growth. It creates drag on every system and decision that depends on doing the right thing — and proving it.

The complexity of the modern compliance landscape has outgrown legacy mindsets. Regulatory pressure is no longer isolated to niche sectors or annual audits. Today’s digital enterprise operates under a web of overlapping, expanding, and increasingly enforced mandates:

- Data protection: GDPR in the EU. CCPA and CPRA in California. India’s DPDP. Brazil’s LGPD. China’s PIPL. Each demands granular control over how data is collected, used, stored, and transferred — with escalating penalties for noncompliance.

- Financial accountability: SOX, Basel II and III, GLBA — all require clear audit trails, control ownership, and real-time reporting.

- Healthcare and safety regulations: HIPAA and OSHA impose strict confidentiality, integrity, and access controls on sensitive data and operational environments.

- Cyber-resilience and security: NIS2, DORA, and the NIST CSF are redefining what it means to be operationally resilient, mandating not just protection, but provable readiness and coordinated incident response.

Compliance is no longer something organizations do after the fact. It’s a condition of doing business, a gateway to customer trust, market access, and regulatory approval. Boards want to know whether policies exist — but also whether they’re enforced. Regulators want more than documentation — they want evidence. Customers expect both.

That’s where IT governance comes in. Not as a reporting line or an audit checklist, but as the system of accountability that assigns ownership, enables traceability, and ensures controls don’t just exist — they function. Governance makes compliance auditable by design and enforceable by structure.

- It protects reputation, avoids penalties, and mitigates the risk of operational shutdowns.

- It builds confidence among regulators, auditors, and customers.

- It creates the conditions for scalability, international expansion, and long-term investment — because no one backs an enterprise that can’t prove it’s in control.

Because compliance isn’t about reacting to rules. It’s about building systems that make conformance inevitable — and defensible.

In a fragmented regulatory environment, sustainable compliance depends on governance that embeds control, ownership, and proof into the fabric of IT.

This article makes the case that compliance, like risk, belongs inside the architecture of IT governance. It builds on our earlier exploration, How to Use IT Governance to Manage Risk Across the Enterprise, by shifting the lens from managing uncertainty to managing obligation — from identifying threats to enforcing requirements.

Why IT Governance Is Essential for Sustained Compliance

There was a time when compliance meant producing a binder — or several — for the auditors. Policies on paper. Signatures on forms. Control lists in spreadsheets. The audit would come, the documents would be reviewed, and — if all went well — the organization would move on, often without changing a thing.

That time is over.

Regulatory expectations have shifted from periodic attestation to continuous assurance. It’s no longer enough to declare compliance once a year; organizations must now demonstrate it on demand, with traceable controls, up-to-date evidence, and provable accountability. And this isn’t just a feature of more aggressive regulators. It’s a response to the reality that digital systems — and the threats they face — don’t operate in fixed cycles.

Enter IT governance.

Governance isn’t a compliance department. It’s not a checklist or an overlay. It’s the system that ensures compliance isn’t accidental, fragmented, or informal. It turns obligations into structures: who owns the policy, who maintains the control, who approves the exception, and who gets the report when things go wrong. Governance embeds compliance where it matters most — in the decisions that shape systems, data, architecture, vendors, and change.

At its core, governance supports three non-negotiables of sustainable compliance:

Clarity of Roles and Ownership

Compliance fails when no one knows who’s responsible — or when everyone assumes someone else is. Governance creates a map of accountability, from the boardroom to the DevOps pipeline. It defines:

- Who owns each policy

- Who implements the controls

- Who monitors their effectiveness

- Who approves exceptions — and under what conditions

This clarity isn’t bureaucratic — it’s foundational. Without it, controls drift, policies stale, and no one can say whether requirements are being met, let alone enforced.

Policy Enforcement and Auditability

A policy without enforcement is just a statement of intent. And in compliance, intent is not enough.

IT governance ensures that policies aren’t just written — they’re operationalized. That means embedding enforcement mechanisms into processes:

- Role-based access control tied to HR systems

- Change management gates linked to risk and compliance reviews

- Automated reminders and escalation paths for control attestations

It also means building auditability into the system — so that every control has a corresponding evidence trail, and every exception is logged, justified, and approved according to a predefined protocol.

Evidence Generation and Traceability

Modern compliance is measured not just by what’s done, but by what can be proven. That requires traceability:

- From regulatory requirement → policy → control → enforcement → evidence

- From system change → impact → control validation → audit record

Governance makes this traceability possible by connecting the dots across departments, systems, and lifecycle stages. It turns compliance from a retrospective search for artifacts into a forward-facing system of accountability — where evidence is generated as part of the process, not as a scramble before the audit.

In short, compliance without governance is unsustainable. It relies on institutional memory, siloed ownership, and the hope that policies will be followed simply because they exist. But hope is not a control — and in regulated environments, it’s not a strategy.

Without governance, compliance relies on memory and manual effort. With governance, it becomes measurable, repeatable, and audit-ready by design.

Governance Roles and Structures That Support Compliance

Compliance doesn’t live in one department. It lives — or fails — in the gaps between them.

A policy approved in isolation. A system launched without controls. A vendor onboarded with unchecked assumptions. These aren’t failures of intent. They’re failures of governance structure — when the right people aren’t in the room, the right responsibilities aren’t defined, and the right questions don’t get asked until it’s too late.

Compliance is a cross-functional responsibility. But cross-functional only works when it’s coordinated. That’s where IT governance steps in — not to centralize every decision, but to ensure that the right roles are involved, at the right levels, with the right mandates, and the right information.

Policy Boards: Defining the Rules of Engagement

Governance begins with policy. But policy doesn’t mean “document” — it means authority. Someone must decide what the rules are, how they apply, and what happens when they’re breached. That’s the role of the Policy Board — or, in mature organizations, the Enterprise Policy Council — which oversees:

- Approval of new or updated compliance policies

- Cross-mapping to relevant regulations and frameworks (e.g., GDPR, ISO 27001)

- Delegation of implementation and enforcement responsibilities

- Reviews of policy effectiveness and alignment with risk appetite

Policy Boards ensure that policies are not just created in reaction to audits, but as part of a proactive governance strategy that scales with regulatory complexity.

IT Steering Committees: Ensuring Compliance in Strategic Decisions

Every project, platform, and vendor carries compliance implications. The IT Steering Committee plays a pivotal role in ensuring that strategic decisions reflect those implications before they harden into code or contracts.

Their role includes:

- Reviewing major IT initiatives for compliance impact

- Requiring evidence of control alignment in business cases and project charters

- Ensuring compliance objectives are represented alongside financial and operational ones

- Holding delivery teams accountable for embedding controls from the start

Without this layer of governance, compliance becomes an afterthought — retrofitted at best, bypassed at worst.

PMO, IT GRC, and Operational Governance Functions

Where Policy Boards define the rules and Steering Committees approve strategic alignment, it’s the Program Management Office (PMO) and IT GRC functions that ensure those rules are applied in practice:

- Integrating compliance checkpoints into project lifecycle governance

- Maintaining a centralized register of controls, exceptions, and attestations

- Coordinating with Security, Risk, and Legal functions on emerging requirements

- Providing executive-level reporting on compliance posture

These teams serve as the operational nerve center for compliance — connecting day-to-day delivery with enterprise-level oversight.

Compliance Governance Roles and Responsibilities

| Governance Role | Compliance Responsibility | Typical Participants |

| Policy Board | Approve, update, and align policies with regulations | Legal, Risk, Compliance, IT |

| IT Steering Committee | Ensure compliance in projects and change initiatives | CIO, PMO, Architecture, Finance |

| PMO / IT GRC Functions | Operationalize controls, track exceptions, report status | GRC leads, Audit liaisons |

Coordination with Legal, Audit, and Compliance Offices

No compliance structure can succeed in isolation. Governance must be designed to interface with the specialized functions responsible for interpretation, enforcement, and assurance:

- Legal and Regulatory Affairs interpret obligations, monitor legislative change, and validate policy language.

- Chief Compliance Officers (CCOs) define enterprise compliance strategy, escalate issues, and lead regulatory engagement.

- Internal and External Auditors verify whether controls are in place, functioning, and supported by evidence.

IT governance does not replace these functions — it connects them. It ensures that their input is not just heard, but acted upon, with structures in place to surface issues, route decisions, and document accountability.

Why Structure Matters

Without a formal governance structure, compliance becomes a shared fiction — everyone believes someone else is handling it. By assigning roles, codifying responsibilities, and embedding compliance into decision-making bodies, governance turns accountability from a slogan into a system.

Because policies don’t enforce themselves.

Decisions don’t make themselves.

And compliance — the kind that stands up in audits, investigations, and board reviews — doesn’t happen by accident.

Governance doesn’t centralize compliance — it coordinates it. Structures like policy boards and GRC functions turn cross-functional intent into accountable execution.

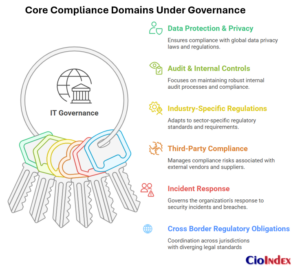

Core Compliance Domains Managed by IT Governance

Compliance isn’t a single obligation — it’s a landscape. And like any landscape, it has terrain: data protection, auditing, sector-specific mandates, and third-party risk. Each domain brings its own requirements, but what unifies them is the need for governance — to turn complexity into coherence, and scattered controls into a system.

Strong IT governance doesn’t just acknowledge these domains. It structures around them, embedding accountability, evidence, and oversight at the places where exposure is greatest — and visibility is often weakest.

Below are four of the most critical compliance domains shaped by governance architecture.

Data Protection and Privacy

Data regulation isn’t just increasing — it’s multiplying. From GDPR and CCPA/CPRA to Brazil’s LGPD, India’s DPDP, and China’s PIPL, organizations face a global patchwork of privacy laws, each with their own requirements for consent, residency, retention, breach notification, and access rights.

Governance ensures these requirements aren’t interpreted ad hoc by IT teams or scattered across disconnected compliance owners. Instead, it embeds data protection into:

- Data lifecycle policies: aligned with retention, deletion, and archival rules

- Access control enforcement: governed by role, purpose, and jurisdiction

- Consent and rights management: tied to system-level functions, not legal memos

- Cross-border transfer assessments: evaluated against transfer impact assessments (TIAs) and binding corporate rules

Without governance, privacy becomes a documentation exercise. With governance, it becomes an operational discipline — enforced where data is created, processed, and shared.

Audit and Internal Controls

Auditability doesn’t start with the auditor — it starts with control design.

From SOX to ISO 27001, regulated organizations are expected to prove not just that controls exist, but that they work — and that any exceptions are documented, approved, and mitigated. Governance ensures:

- Control libraries are centralized, mapped to policies, and updated as regulations evolve

- Evidence requirements are clearly defined and traceable to control owners

- Exception processes are standardized, reviewed, and risk-assessed

- Remediation and retesting is tracked across audit cycles and tied to KPIs

Governance doesn’t eliminate the burden of audits — it makes them manageable, repeatable, and less disruptive. And more importantly, it provides executives with confidence in the integrity of their compliance posture — before an audit ever begins.

Regulated Industry Mandates

Some sectors don’t just face compliance — they operate in it. Financial institutions, healthcare providers, critical infrastructure, and public-sector agencies must design their IT systems around specific regulatory frameworks, including:

- PCI-DSS for payment security

- HIPAA and HITECH for patient data and digital health systems

- FFIEC, GLBA, and Basel III for banking and financial services

- DORA and NIS2 for cyber-resilience across EU-regulated industries

Governance provides the bridge between sector-specific requirements and operational realities. It ensures:

- Controls are embedded early in system design and procurement processes

- Policy updates are triggered by changes in the regulatory environment

- Certifications (e.g., SOC 2, ISO 27001) are maintained through sustained governance practices — not one-off efforts

This is where governance becomes not just a compliance tool, but a license to operate.

Third-Party and Vendor Compliance

An organization is only as compliant as its vendors. And yet, third-party risk remains one of the most overlooked compliance exposures.

IT governance helps address this by:

- Embedding compliance requirements in vendor onboarding and contracting

- Requiring attestations, third-party audits, or certifications as conditions of service

- Ensuring that SLAs include compliance reporting, incident notification timelines, and shared responsibility models

- Maintaining a vendor compliance register integrated with the organization’s risk and audit functions

When governance ignores vendors, compliance gaps become inevitable. When governance includes them, those gaps become manageable — with accountability mapped and monitored like any other part of the business.

Compliance isn’t one thing — it’s a system of systems. IT governance connects those systems across domains, turning siloed obligations into coordinated, enforceable controls.

Governance Mechanisms That Support Compliance

A policy is only as strong as the mechanism that enforces it.

Too many organizations write rules with no infrastructure to apply them. Policies sit in binders or shared drives, unenforced and unread, while real decisions happen in project plans, ticketing systems, and developer backlogs. The result isn’t just misalignment — it’s noncompliance, even when the intent is good.

Governance mechanisms solve this by embedding compliance into the operational core of how IT decisions are made, reviewed, and recorded. These are the scaffolding of compliance: structured, scalable, and visible — not just to regulators, but to leaders responsible for execution.

Below we discuss five foundational governance mechanisms that move compliance from documentation to discipline.

Policy Governance

Every control starts with a rule. But governance determines whether that rule is:

- Consistently reviewed and updated

- Approved through the right authority structure

- Communicated to those it affects

- Mapped to enforcement mechanisms and evidence requirements

Policy governance is not just about documentation. It’s about traceability — ensuring every policy is linked to its owner, mapped to regulatory sources, and implemented in enforceable, testable ways.

Change Management

Change is where compliance lives or dies. Systems evolve, data flows shift, vendors update terms — and with each change comes the risk of misalignment or control failure.

Governance-integrated change management ensures that:

- Compliance impact assessments are triggered automatically for system or data changes

- Regulatory stakeholders (legal, audit, security) are included in approvals

- Control revalidations and test cases are embedded in post-change processes

- Exceptions are logged, justified, and routed for formal approval

This mechanism turns change from a blind spot into a checkpoint.

Control Libraries

When compliance is managed ad hoc, controls multiply — and conflict. One team implements PCI-DSS. Another aligns to ISO. A third builds controls for GDPR. The result? Redundancy, contradiction, and audit fatigue.

Governance addresses this through centralized, curated control libraries that:

- Map each control to applicable frameworks (e.g., NIST, ISO, SOX, GDPR)

- Standardize language, ownership, evidence expectations, and frequency

- Enable cross-framework alignment and control rationalization

This is the compliance equivalent of architectural reuse — codifying what works, and using it consistently.

Exception Management

No control fits every situation. But unmanaged exceptions are among the fastest paths to compliance breakdown — especially when they’re undocumented, retroactive, or handled informally.

Governance ensures that exceptions:

- Follow a defined approval workflow

- Are risk-assessed and documented with clear justifications

- Include compensating controls or remediation plans

- Are reviewed periodically for renewal or closure

Exception handling isn’t a loophole — it’s a mechanism for risk-based compliance, applied with discipline.

Compliance Dashboards and Reporting

What isn’t visible can’t be governed. And what isn’t measured doesn’t get prioritized.

Governance supports continuous visibility through dashboards that:

- Surface control status, exceptions, overdue actions, and evidence gaps

- Provide drill-down capability for auditors, risk committees, and senior leadership

- Integrate with GRC platforms, ITSM tools, and data governance systems

- Track performance over time — not just compliance, but compliance maturity

Dashboards don’t replace governance — they expose it. They make the invisible visible, the abstract measurable, and the strategic accountable.

Governance Mechanisms that Support Compliance

| Governance Mechanism | Compliance Function |

| Policy Governance | Approval, traceability, version control |

| Change Management | Trigger compliance checks during system changes |

| Control Libraries | Prevent duplication, standardize enforcement |

| Exception Management | Risk-based approval and escalation for nonconformance |

| Dashboards & Reporting | Continuous visibility into status, gaps, and trends |

Policies don’t enforce themselves — systems do. Governance mechanisms make compliance executable, measurable, and scalable across a moving IT landscape.

Tools That Enable Governance-Led Compliance

Governance isn’t a software feature. But without the right tools, even the best-designed compliance frameworks degrade into spreadsheets, emails, and trust-based processes. At scale, that’s not just inefficient — it’s untenable.

The complexity of modern compliance — overlapping frameworks, multijurisdictional obligations, constant change — requires technology that makes governance enforceable and compliance sustainable. But tools don’t solve the problem on their own. What matters is how they’re deployed: as part of a governed system that turns obligations into workflows, policies into automation, and risk into visibility.

Let’s look at the four tool categories that support governance-led compliance — not as bolt-ons, but as integral components of a structured compliance architecture.

GRC Platforms

Governance, Risk, and Compliance (GRC) platforms are the nerve centers of enterprise compliance. When integrated well, they serve as the single source of truth for controls, policies, evidence, exceptions, and audit trails.

Examples include:

- ServiceNow GRC – well-suited for organizations already using ServiceNow ITSM

- RSA Archer – highly configurable, robust reporting and dashboard capabilities

- MetricStream – strong in cross-enterprise GRC alignment

- LogicGate, Riskonnect, and OneTrust – popular in mid-market or specific domains (e.g., privacy, third-party risk)

Effective deployment includes:

- Mapping controls to regulatory frameworks and policies

- Assigning ownership and workflows for evidence collection

- Integrating risk scoring and exception management

- Providing dashboards for leadership, audit, and legal functions

Without governance, these platforms become record-keeping systems. With governance, they become decision-support engines.

Workflow Automation Tools

The difference between stated policy and operational compliance is execution. That’s where workflow automation comes in — ensuring the right tasks happen at the right time, with the right oversight.

Examples:

- Policy attestation workflows for users and system owners

- Access review automation triggered by HR or system changes

- Change advisory board (CAB) approval workflows with embedded compliance checks

- Compliance impact notifications tied to system or data-level changes

These tools don’t just streamline compliance — they enforce it. And when integrated with governance bodies and escalation paths, they make sure nonconformance isn’t just logged — it’s acted upon.

Evidence Collection and Audit Readiness Tools

Proving compliance isn’t about volume — it’s about validity. Collecting logs, screenshots, or forms means little if they’re inconsistent, unverifiable, or disconnected from the control they’re supposed to support.

Modern tools help:

- Automate log collection from systems and applications (e.g., SIEM integrations)

- Tag and link evidence directly to control frameworks and audit objects

- Maintain time-stamped, tamper-evident audit trails

- Support “audit-ready by default” principles — so evidence is generated as part of regular operations, not rushed before reviews

Some organizations also leverage tools like Confluence, Jira, and SharePoint — not as compliance systems, but as structured, permissioned repositories — governed by policy, retention rules, and access controls.

Compliance Dashboards and Reporting Tools

Dashboards are where governance meets leadership. They turn compliance into something that can be seen, tracked, and managed — not just by compliance officers, but by CIOs, boards, and business units.

Strong dashboards include:

- Status by control domain (e.g., data privacy, financial, operational)

- Heat maps of overdue items, open exceptions, and evidence gaps

- Trends over time: control performance, audit findings, issue recurrence

- Drill-down views for operational teams; roll-ups for executives

Whether built into a GRC tool or developed through BI platforms like Power BI or Tableau, dashboards make governance visible — and that visibility drives accountability.

Tools don’t create compliance — but they can enforce, automate, and expose it. Under governance, technology becomes an enabler of control, not just a container for documentation.

Addressing Compliance Fatigue

Compliance doesn’t usually break all at once. It wears down.

A missed review. An overdue control. A policy no one updates because “we just did that last year.” Over time, even the most mature compliance programs begin to suffer from a kind of organizational exhaustion — where the intent is still there, but the energy isn’t. This isn’t neglect. It’s compliance fatigue — and it’s one of the most underappreciated threats to sustained governance.

What causes it? Not just volume — though that plays a role. More often, it’s the accumulation of overlapping frameworks, conflicting timelines, duplicative controls, and audit overload. When teams feel like they’re managing the same compliance objective six different ways for six different stakeholders, alignment breaks down. So does motivation.

Governance, done well, isn’t just about structure and control. It’s also about sustainability. That means building systems that scale without burning people out — and aligning processes so that compliance supports performance, not just policing it.

Rationalize, Don’t Replicate

One of the most common sources of fatigue is control duplication — especially in organizations subject to multiple overlapping regulations (e.g., SOX, ISO, GDPR, PCI-DSS). The solution isn’t more checklists — it’s governance-led control harmonization.

That means:

- Mapping controls across frameworks to identify overlaps

- Creating a master control library with reusable objects

- Standardizing language, ownership, and evidence expectations

- Avoiding one-off controls that serve only one audience or audit

When the same control satisfies three obligations, everyone wins — legal, audit, and operations.

Prioritize by Risk and Materiality

Not all compliance efforts carry the same exposure. A delayed vendor risk review isn’t the same as a misconfigured access control to protected health data. But when governance treats them the same — with the same urgency, escalation, and reporting — teams lose trust in the system.

Governance helps recalibrate focus by:

- Applying risk-based compliance models to weigh control priority

- Tiering controls into Essential, Enhanced, and Exceptional levels

- Focusing oversight where the potential for harm or regulatory scrutiny is highest

This approach aligns resources with risk — and reduces unnecessary friction in low-impact areas.

Streamline Reviews and Attestations

Policy reviews, control attestations, and risk acknowledgments are critical. But when every stakeholder is asked to approve dozens of items every quarter, two things happen: engagement drops, and errors increase.

Governance mitigates this by:

- Staggering review cycles based on risk, system criticality, or control volatility

- Automating low-risk renewals where data shows stability

- Creating attestation bundles — so related controls can be reviewed once, not five times

Efficiency isn’t just about speed — it’s about reducing mental overhead while maintaining assurance.

Reinforce the “Why” — Not Just the What

Compliance fatigue often stems from detachment — when teams don’t understand the reason behind what they’re being asked to do.

Governance helps by:

- Connecting controls to business risk, not just regulatory language

- Reporting on positive outcomes (e.g., avoided fines, closed gaps, improved ratings)

- Involving stakeholders in control design, not just enforcement

When compliance is framed as part of enterprise performance and resilience — not just a burden — participation becomes easier to sustain.

Fatigue is a governance problem, not a people problem. Sustainable compliance systems reduce duplication, prioritize by risk, and focus on clarity over complexity.

Accountability, Escalation, and Enforcement

Policies don’t fail because they’re misunderstood. They fail because they’re unenforced.

Many organizations have compliance frameworks that look sound on paper: policies, controls, approvals, documentation. But when something breaks — a data breach, an audit failure, a regulatory inquiry — it’s often not the absence of a rule that’s the problem. It’s the absence of clear accountability and effective escalation when the rule is ignored, misunderstood, or deprioritized.

Governance solves this by turning policy into operational posture. It doesn’t just define what must happen — it defines who is responsible, how violations are surfaced, and what the consequences are when things fall through. In other words: governance brings teeth to compliance.

Defining Ownership: Who Is Accountable for What

Accountability begins with clarity. Every control, policy, and compliance objective must have an owner — not just in name, but in action.

IT governance ensures:

- Control ownership is documented, communicated, and tied to performance

- Policy owners are responsible for updates, reviews, and effectiveness

- System owners are accountable for the compliance posture of their platforms

- Vendor owners are responsible for ensuring third-party compliance obligations are met

This is more than role definition — it’s operational mapping. Governance turns accountability into part of the organization’s control architecture.

Escalation Pathways: Surfacing Issues Before They Become Incidents

Noncompliance doesn’t always signal failure — sometimes it signals trade-offs, system limitations, or timing conflicts. But when it’s not surfaced, it becomes exposure.

Governance ensures that escalation isn’t just reactive — it’s structured. This includes:

- Predefined compliance thresholds that trigger alerts or reviews

- Escalation chains by domain (e.g., data, access, vendor, regulatory)

- Regular compliance status reporting to IT Steering Committees, Audit Committees, or Risk Boards

- Embedded escalation logic in change management, incident response, and access governance

When issues rise predictably, they can be resolved proactively — not defensively.

Enforcement: Internal Consequences and External Obligations

Compliance without consequences is suggestion, not strategy.

Enforcement in governance doesn’t necessarily mean punishment — but it does mean action. Governance frameworks must define:

- What happens when controls are bypassed or ignored

- What types of violations require executive notification or regulator disclosure

- What remediation timelines apply to critical failures

- What happens when patterns of noncompliance emerge across departments or systems

Enforcement can include:

- Retraining and awareness initiatives

- Temporary privilege restrictions

- Escalated project reviews or delays

- Formal documentation of control failures in leadership reports

For regulated organizations, governance must also define the triggers for:

- Regulatory breach reporting (e.g., GDPR, HIPAA, NIS2)

- Engagement with internal legal counsel and external regulators

- Public disclosure thresholds and communication protocols

This is where governance intersects not just with IT, but with legal, ethical, and reputational responsibility.

Codifying Responsibility Through Governance Charters and RACI Models

To make accountability enforceable, it must be documented — not assumed. Governance structures use tools such as:

- RACI models to clarify who is Responsible, Accountable, Consulted, and Informed

- Governance charters for compliance committees and control councils

- Control responsibility matrices aligned to business units, systems, and geographies

These aren’t just artifacts. They are the blueprints of execution — and critical in demonstrating maturity during audits, regulatory reviews, and internal assessments.

Compliance breaks down where accountability blurs. Governance enforces clarity — assigning ownership, surfacing risk, and defining what happens when the rules are ignored.

Governance for Multijurisdictional Compliance

For global organizations, compliance isn’t just complex — it’s conflicting.

Data can no longer flow freely without scrutiny. Regulations differ — not just in scope, but in intent. What’s permitted in one country may be restricted in another. A breach in one region may require notification within 24 hours; in another, 72. In some jurisdictions, personal data must remain within borders. In others, transfer is allowed — but only with binding safeguards. The result? A legal and operational patchwork where missteps are easy and harmonization is anything but.

The technical challenges are significant. The legal ones, even more so. But the real challenge is governance — because without a structure that coordinates policy, ownership, and enforcement across jurisdictions, compliance becomes inconsistent, fragmented, and ultimately, indefensible.

The Fragmented Regulatory Landscape

Privacy and data protection laws have expanded globally — and they don’t align:

- GDPR prohibits data transfers outside the EU without adequate safeguards.

- China’s PIPL imposes strict localization requirements and cross-border transfer assessments.

- India’s DPDP Act and Brazil’s LGPD emphasize consent and purpose limitation with strong enforcement provisions.

- California’s CPRA adds additional transparency, opt-out, and enforcement layers to CCPA.

These laws overlap in principle but diverge in execution. They demand clarity in data mapping, consent, usage limitation, breach reporting, and transfer protocols — and they increasingly require proof, not just policy.

How IT Governance Creates Consistency Across Jurisdictions

Without a governance layer, global compliance efforts fracture into local interpretations — often with competing priorities, inconsistent documentation, and uneven control maturity.

Governance addresses this by:

- Establishing enterprise-wide compliance policies with local adaptations

- Creating a compliance architecture that spans regions, business units, and data systems

- Embedding local compliance officers or liaisons into the governance structure

- Using centralized GRC systems to track obligations, controls, exceptions, and reporting requirements by region

This model allows for both global consistency and local accountability — with shared frameworks but jurisdiction-specific execution.

Managing Cross-Border Data Transfers and Localization Requirements

Governance supports the enforcement of transfer and localization obligations through:

- Data mapping exercises that track how and where personal data flows

- Enforcing Transfer Impact Assessments (TIAs) or equivalent risk reviews

- Managing Standard Contractual Clauses (SCCs) and Binding Corporate Rules (BCRs)

- Coordinating between IT, legal, and security teams to ensure enforcement within architecture and vendor relationships

These aren’t one-time efforts — they are living governance practices, with controls that require monitoring, review, and adaptation.

Navigating Global Breach Reporting and Incident Response Requirements

Governance ensures incident response aligns with jurisdictional requirements by:

- Defining reporting thresholds and timelines by geography

- Coordinating with internal legal, compliance, and security functions

- Embedding escalation paths into security incident and change management processes

- Tracking notification outcomes in a GRC system or compliance log

This coordination turns fragmented requirements into repeatable playbooks — so when a breach occurs, the question isn’t “who decides?” but “which protocol applies?”

Harmonizing Through Governance Playbooks

Leading organizations use governance to develop compliance playbooks that:

- Align core policies to global standards (e.g., ISO 27701 for privacy)

- Map control differences between jurisdictions

- Train teams on localized compliance execution while maintaining centralized visibility

- Guide implementation of new tools or practices in light of new regulations

These playbooks don’t replace local laws — they translate them into operational terms across the enterprise.

In a multijurisdictional world, governance isn’t just helpful — it’s essential. It harmonizes global principles with local execution, ensuring compliance isn’t just declared, but delivered, wherever business happens.

Compliance Maturity and Benchmarking

Compliance is not a finish line. It’s a posture — one that must evolve as regulations shift, technologies change, and business models adapt. Yet many organizations still approach compliance as a binary outcome: pass or fail, audit-ready or not. That thinking is not just outdated — it’s dangerous.

Mature organizations understand that compliance must be managed as a continuum, not a checkbox. It must be measured, benchmarked, and continuously improved — just like any other core business capability. And that improvement doesn’t happen through reactive audits or scattered control updates. It happens through governance: structured oversight that supports consistent evaluation, comparative insights, and strategic progress.

What Compliance Maturity Really Means

Compliance maturity isn’t about how many policies you have. It’s about how effectively those policies are owned, enforced, measured, and improved.

Governance frameworks help define and assess maturity across several dimensions:

- Control effectiveness: Are controls consistently implemented and monitored?

- Ownership and accountability: Are responsibilities clear and enforced?

- Evidence quality: Is compliance provable, current, and complete?

- Adaptability: Can the organization adjust to regulatory change without disruption?

- Integration: Is compliance embedded in decision-making, change management, and risk processes?

Mature organizations build compliance into operations. Immature ones treat it as a project.

Benchmarking Against Frameworks and Peers

Governance enables benchmarking not just against internal baselines, but also against external standards and industry peers.

Useful models include:

- COBIT Performance Management (CPM) for governance maturity

- NIST Cybersecurity Framework tiers for risk-informed compliance

- ISO 27001/27701 maturity models for information security and privacy

- Custom internal scoring models aligned with business-specific risks and control expectations

Benchmarking enables organizations to:

- Set realistic improvement targets

- Identify lagging control domains

- Justify investment in compliance tools, processes, or personnel

- Communicate progress to boards, auditors, and regulators

Governance gives these benchmarks teeth — ensuring assessments are repeatable, traceable, and tied to action plans.

From Audit-Readiness to Continuous Assurance

Audit-readiness is no longer enough. Regulators and stakeholders increasingly expect ongoing compliance, with visibility into how obligations are met between formal assessments.

Governance supports this shift through:

- Real-time control monitoring via GRC platforms and automation

- Continuous evidence collection instead of manual evidence pulls

- Regular internal reviews and control testing embedded into operations

- Dashboards that track compliance health over time, not just point-in-time status

Continuous assurance is a maturity milestone — and a direct outcome of governance that is integrated, not isolated.

Building a Culture of Improvement

Maturity isn’t just procedural — it’s cultural. Governance plays a key role in setting the tone by:

- Making compliance performance visible at all levels

- Including maturity objectives in governance charters and committee KPIs

- Recognizing and rewarding improvements, not just preventing failures

- Linking compliance maturity to strategic goals like market expansion, certifications, or investor readiness

Compliance isn’t static because the world isn’t. Governance keeps the enterprise ready — not just for audits, but for what’s next.

Maturity isn’t about how much compliance you do — it’s about how well you govern it. Benchmarking, continuous assurance, and structured oversight turn compliance into a competitive asset.

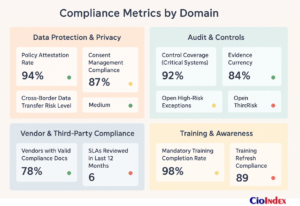

Making Compliance Visible: Key Metrics

If governance is the engine of compliance, metrics are the dashboard.

They tell you what’s working, what’s missing, and what’s about to go wrong. Yet many organizations still operate in the dark — flooded with controls, checklists, and evidence artifacts, but unable to answer simple questions: Are we compliant? Where are we exposed? Who’s responsible?

The problem isn’t just lack of data. It’s lack of structure. When compliance metrics are improvised, disconnected, or overly tactical, they don’t drive insight — they drive confusion. Governance solves this by making compliance measurable by design. It defines what gets measured, how often, by whom, and why — and embeds those metrics into the systems where compliance actually happens.

Because in today’s regulatory environment, visibility isn’t optional. It’s what makes compliance real.

Why Metrics Matter in Compliance Governance

Compliance that can’t be measured can’t be managed — or defended.

Metrics turn policies into performance, risk into reports, and regulatory obligations into trackable accountability. Without metrics, organizations rely on anecdote, assumption, and best effort. With metrics, they manage by evidence.

Governance ensures:

- Metrics are defined with purpose — not just for reporting, but for decision-making

- Accountability is assigned — every metric has an owner, not just a collector

- Review cycles are enforced — metrics are monitored in the same cadence as strategy and risk

- Dashboards are built for insight, not noise — layered views for operations, executives, and auditors

What Makes Metrics Meaningful

Not every number tells a story worth hearing. Governance disciplines which metrics matter by focusing on attributes that connect to compliance outcomes:

- Relevant to actual obligations — not just what’s measurable, but what’s meaningful

- Actionable — tied to ownership, thresholds, and escalation paths

- Auditable — with source traceability and data integrity

- Contextual — interpreted in relation to business function, risk exposure, and control maturity

- Visible at the right altitude — operational for teams, strategic for leaders

Without these attributes, metrics become vanity — impressive on slides, useless in practice.

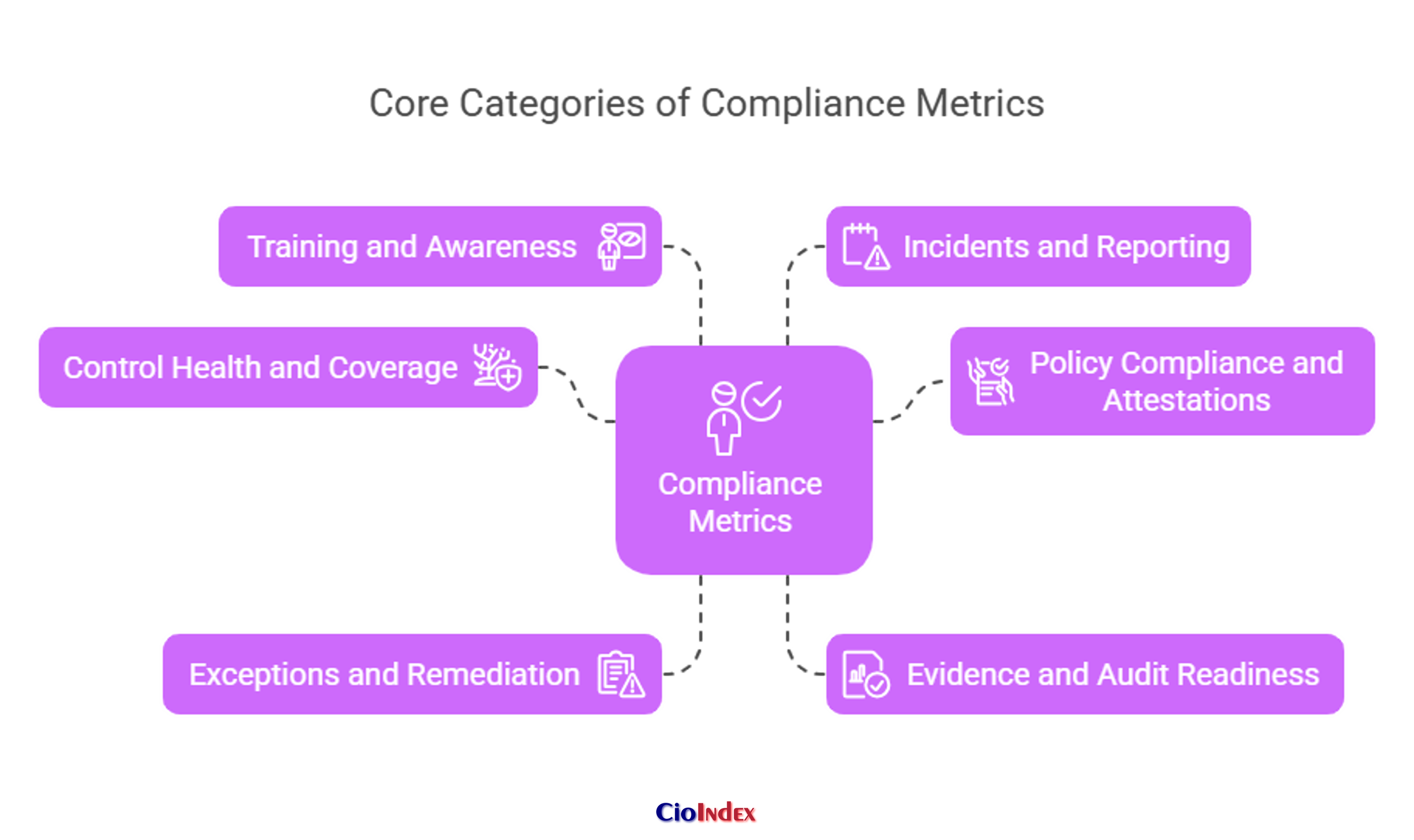

Core Categories of Compliance Metrics

Strong governance programs track compliance metrics across the full lifecycle — from design to execution to assurance. Key categories include:

Control Health and Coverage

- % of controls implemented vs. required

- % of high-risk systems with full control mapping

- % of controls tested successfully in the last cycle

- Average time to implement new controls following regulatory updates

Policy Compliance and Attestations

- % of users completing mandatory policy acknowledgments

- % of policies reviewed or updated within scheduled cycle

- % of systems or processes with no assigned governing policy

Exceptions and Remediation

- Number of open compliance exceptions by severity

- Mean time to close exceptions

- % of exceptions with compensating controls in place

- % of overdue remediations from internal or external audits

Evidence and Audit Readiness

- % of controls with current, complete evidence artifacts

- Average time to produce requested evidence during audit

- Evidence completeness score by business unit or control domain

Training and Awareness

- Compliance training completion rate (overall and by role)

- Frequency of training refresh aligned to policy changes

- % of users flagged for retraining after control or audit failures

Incidents and Reporting (Where Applicable)

- Number of compliance-related incidents logged

- Time to escalate and report based on jurisdictional requirements

- Root cause completion rate for resolved incidents

These aren’t exhaustive but together, they form the core of a compliance posture dashboard — one that governance bodies can use to track real performance, not just documentation.

Governance’s Role in Metric Oversight

Governance isn’t just the source of metrics — it’s the system that makes them credible.

Effective governance:

- Defines KPIs per compliance domain (e.g., data privacy, financial, operational)

- Assigns ownership of each metric to a named role — not a generic function

- Integrates metrics into governance committee charters, dashboards, and meeting agendas

- Uses GRC tools to ensure metric integrity, version control, and reporting alignment

- Audits metrics themselves — ensuring what gets reported reflects what’s actually happening

In short: governance turns metrics from passive reporting into active oversight.

From Metrics to Strategic Insight

Good metrics don’t just show progress. They reveal patterns, expose blind spots, and justify change.

Governance enables organizations to:

- Prioritize remediation based on metric trends (e.g., rising exceptions in a key domain)

- Justify investment in automation or headcount

- Benchmark internal teams or business units

- Present credible data to boards, regulators, and auditors

In mature programs, compliance metrics become part of enterprise performance management — not just control oversight.

Pitfalls to Avoid

Even with governance, metric programs can drift. Common mistakes include:

- Tracking what’s easiest to measure instead of what matters

- Duplicating metrics across tools without reconciliation

- Assigning ownership without accountability

- Reporting lagging indicators with no action plan

Governance disciplines both the definition and use of metrics — ensuring they serve the compliance system, not just the audit trail.

Maturity Through Measurement

As organizations mature, so do their metrics. They move from:

- Binary reporting (“Are we compliant?”) to

- Performance evaluation (“How well are we complying?”) to

- Predictive insight (“Where will we fall short next?”)

Governance structures make this evolution possible. They provide the consistency, cadence, and accountability that metrics require to matter — and to improve.

Metrics turn compliance from principle into practice. Governance ensures they’re relevant, visible, and tied to decisions that matter.

In Conclusion

Compliance isn’t the cost of doing business. It’s the condition of staying in it.

For too long, organizations have treated compliance as a necessary inconvenience — a checkbox exercise to survive audits, avoid penalties, and satisfy regulators. But that mindset won’t hold in today’s environment. The regulatory landscape is too fragmented. The operational stakes are too high. And the expectation from boards, customers, and governments is no longer just that compliance exists — but that it is proven, sustainable, and strategic.

This is where IT governance earns its name. Not as a compliance department in disguise, but as the structure that makes conformance possible at scale — by assigning ownership, enforcing accountability, embedding controls, and connecting policies to performance. Governance doesn’t just help organizations meet their obligations. It helps them own their outcomes.

What this article has shown — from policy boards and control libraries to dashboards and metrics — is that real compliance isn’t just about doing the right thing. It’s about building systems that ensure it’s done consistently, visibly, and verifiably. And when that system is in place, compliance stops being a drag on innovation. It becomes a condition for it.

Because when compliance is governed well, it protects trust, accelerates execution, reduces risk, and signals maturity. It strengthens reputations. Enables market access. Builds investor confidence. And when something goes wrong — as it eventually will — it shows you were prepared.

The organizations that lead tomorrow won’t just be the most compliant. They will be the ones who turn compliance into a competitive advantage.

For deeper insights and complete understanding check out our IT Governance Body of Knowledge available exclusively to our members.