The question sounds simple—how much do CIOs make?—but CIO compensation is one of the easiest executive pay topics to misunderstand. That’s because the title “CIO” is not a standardized role. In one organization it means “head of infrastructure and support.” In another, it means “enterprise transformation executive accountable for cybersecurity resilience, cloud economics, major vendor contracts, and a multi-year modernization portfolio.” Those are different jobs, and the market prices them differently.

That’s also why most “average CIO salary” headlines are only mildly useful. They often blend incomparable roles, ignore total compensation, and skip the factors boards and HR actually use to set pay: organizational scale, regulatory burden, IT budget and complexity, the CIO’s span of control (apps, infrastructure, security, data), and whether the role is expected to run the business, change the business, or both.

Whether you’re an aspiring CIO trying to understand realistic compensation pathways, a current CIO calibrating pay to scope and mandate, or an HR/board leader setting competitive executive packages, this article translates CIO pay into comparable benchmarks—anchored in company size, industry, bonus design, and equity.

In brief: CIO compensation typically includes base salary, an annual bonus (often a percentage of base tied to company and individual performance), and—more commonly in larger organizations or public/PE-backed companies—long-term incentives such as equity. The most accurate way to benchmark “how much a CIO makes” is not by title, but by company size, industry/regulatory pressure, and role scope (global footprint, IT budget, span of control, cyber-risk accountability, and transformation mandate). In practice, CIO total compensation can vary widely even among companies of similar revenue because complexity and risk exposure are priced as heavily as scale.

What this article covers:

- How CIO pay is structured (base salary, bonus, equity/long-term incentives)

- Benchmarks by company size and industry, and how to interpret ranges responsibly

- Typical bonus targets and the performance measures that most often drive payouts

- When equity shows up, what forms it takes, and how to compare it fairly

- A scope-based checklist to sanity-check compensation for a specific CIO role

CIO Pay Depends on Scope—Not the Title

The market doesn’t price the label “CIO.” It prices the scope underneath it: risk, complexity, accountability, span of control, and the size of the change agenda. Without scope, benchmarks turn into loose comparisons between different jobs.

Why “CIO” Isn’t a Standardized Job

The CIO title covers roles with materially different mandates:

- Enterprise CIO: sets technology direction across the organization, carries portfolio-level accountability, and tends to have regular executive and board exposure.

- Divisional or regional CIO: owns strategy and delivery for a business unit or geography, with deep complexity but narrower enterprise influence.

- “Head of IT” titled CIO: serves as the senior-most technology leader in smaller or less centralized environments, often with a role weighted toward operations rather than enterprise-wide strategy.

The largest difference comes from what the organization expects the CIO to deliver:

- Run mandate: reliability, cost efficiency, service levels, vendor performance, and controlled technical debt.

- Change mandate: modernization, digital enablement, platform strategy, operating model shifts, and measurable enterprise outcomes.

Compensation shifts again when the CIO also owns domains that expand executive accountability:

- Security (or shared accountability with a CISO)

- Data/analytics (platforms, governance, value delivery)

- Digital/product (customer-facing platforms, product operating model)

- Enterprise applications (ERP/CRM ecosystems, integration)

- Shared services (service management, standardization, productivity platforms)

When these sit under the CIO, the role resembles a broader enterprise executive position with a different pay profile than an operations-first IT leader.

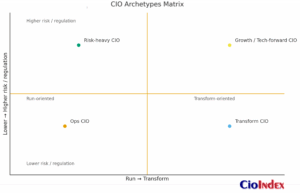

The CIO Archetypes That Affect Pay

Most CIO roles cluster into a few archetypes. The archetype matters because it predicts what outcomes the organization will pay for—and how compensation is structured.

Run / Operations CIO: Priced around reliability and operating discipline: uptime, service levels, predictable delivery, stakeholder satisfaction, and cost control (including vendors).

Transform CIO: Priced around modernization outcomes: platform shifts, legacy reduction, operating model change, and the ability to deliver benefits without destabilizing operations.

Risk / Security-Heavy CIO: Priced around resilience and risk reduction, especially in regulated or high-exposure sectors. Even with a CISO, many CIOs carry accountability for security-by-design, audit readiness, third-party risk posture, and recovery capability.

Growth / Tech-Forward CIO: Priced around speed and competitive enablement in scaling organizations. The role often sits closer to product and engineering, with compensation more likely to include meaningful equity.

Hybrid CIO + CDO / CAIO Scope: Breadth can command a premium when it comes with measurable outcomes—revenue enablement, cycle-time reduction, risk reduction, or productivity gains. Labels rarely move pay; accountable results do.

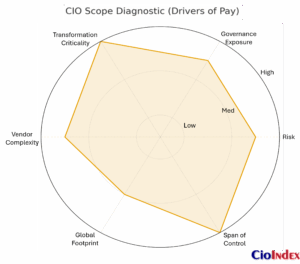

The CIO Scope Checklist for Pay Benchmarking

These factors explain why two CIO roles that look similar on paper can land in very different compensation ranges.

Organization scale and footprint

- Company revenue and/or headcount

- Geography: single-country vs multi-region vs global operations

Technology economics and complexity

- IT budget size (absolute and relative to revenue)

- Vendor portfolio complexity (strategic partners, outsourcing, multiple SIs)

Span of control

- Functions reporting into the CIO: infrastructure, applications, enterprise architecture, PMO, data/analytics, cybersecurity, product/digital, shared services

- Centralized vs federated model (and the coordination load it creates)

Governance exposure

- Board and/or audit/risk committee interaction

- Executive scrutiny during high-severity incidents

Transformation agenda

- Portfolio size and criticality

- Incremental improvement vs platform-level change

Risk and regulatory burden

- Regulatory intensity and audit cadence

- Third-party risk (critical vendors, concentration risk, supply chain exposure)

- Operational risk profile (critical infrastructure, always-on platforms)

Takeaways

- Aspiring CIO: Describe scope in business terms—risk, outcomes, and executive accountability.

- Current CIO: Track scope creep and accountability shifts; they provide the proof for re-benchmarking pay.

- HR/Boards: Benchmark the role you need—mandate, complexity, and risk—rather than the title.

What CIO Compensation Includes (and How to Compare Offers)

“CIO salary” is usually shorthand for a broader package. Two roles can post similar base pay and still differ sharply in value once you account for bonus design, long-term incentives, and executive protections. For benchmarking, the goal is simple: compare like with like.

Base Salary: What It Reflects

Base salary usually reflects three forces:

- Market level for the role (what comparable employers pay for comparable scope)

- Internal equity (how the organization prices peer executives and adjacent roles)

- Scope and mandate (risk exposure, span of control, transformation agenda)

Base tends to move slowly because it anchors the company’s pay structure. Scope changes faster than pay bands. A CIO can inherit security, data, or a major transformation portfolio in a single planning cycle, while base catches up over one or more compensation reviews.

Annual Incentive / Bonus: Cash at Risk

The annual incentive is the most common “pay-for-performance” lever in CIO packages. It has two numbers that matter:

- Target bonus: the percentage of base the CIO earns for meeting expectations.

- Actual payout: what gets paid after performance is evaluated.

Payout mechanics usually blend:

- Company performance modifiers (enterprise financial results, strategic objectives, shareholder outcomes, operating margin)

- Individual or functional scorecards (delivery outcomes, resilience, risk reduction, cost targets, stakeholder measures)

This structure matters for comparability. Two CIOs with the same target bonus can have very different likelihood of payout depending on whether the plan is heavily tied to corporate performance, heavily tied to role scorecards, or subject to discretionary judgment.

Long-Term Incentives (Equity / LTI): Why Total Compensation Jumps

Long-term incentives exist for two reasons: retention and alignment with outcomes that take time. Major modernization, operating model change, cybersecurity maturity improvements, and platform consolidation rarely fit neatly into a single annual bonus cycle.

Common LTI vehicles include:

- RSUs (Restricted Stock Units): shares that vest over time; more common in public companies

- Stock options: value depends on appreciation; common in growth and equity-heavy environments

- Performance shares/PSUs: vest based on multi-year performance targets

- Private equity instruments: profit interest, rollover equity, or other value-sharing structures tied to an exit

- Retention grants: designed to reduce flight risk during multi-year change

When LTI enters the package, “CIO pay” shifts from annual cash compensation to a longer-horizon value model. That changes how candidates evaluate offers and how boards think about pay alignment.

Benefits, Perks, and Executive Protections

Benefits rarely drive headlines, but they can materially change the economics of an offer—especially at senior levels and in high-risk environments.

Common components include:

- Retirement contributions and deferred compensation (where available)

- Executive benefits and allowances (varies widely): car allowance, club membership, professional memberships, enhanced travel/security support, wellness programs

- Executive protections: severance terms, change-in-control provisions, and other clauses that address the risk profile of an executive role

These items matter most when the role carries high volatility: turnarounds, post-merger integration, public-company scrutiny, or heightened cyber exposure.

The Comparability Rules for CIO Pay

Benchmarking gets distorted when people compare different definitions of “compensation.” Use these rules to keep comparisons clean.

Compare the same compensation lens

- Base salary: fixed cash compensation

- Cash compensation: base + annual bonus payout

- Total compensation: cash compensation + LTI value + benefits/protections (where meaningful)

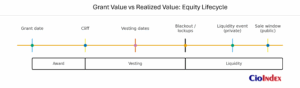

Treat equity carefully

- Grant value vs realized value: grant values are estimates; realized values depend on vesting and price performance.

- Vesting schedules and refresh grants: two offers with similar headline equity can differ in annualized value.

Separate public and private structures

- Public companies tend to have clearer equity programs and disclosures.

- Private companies often rely more on cash and may structure long-term incentives differently.

Account for location and policy realities

- Some employers use geo-based pay bands; others price the role nationally.

- Remote and hybrid policies can affect offer structure and how pay bands are applied.

Takeaways

- Aspiring CIO: Learn the pay mix early. Base is only one part of the package, and senior roles are priced in outcomes, not titles.

- Current CIO: Negotiate the mix to match the mandate. High transformation or risk accountability should show up in bonus design, LTI, or protections—not only in base.

- HR/Boards: Total compensation is the clearest lens at enterprise scale. Base alone often underprices risk and long-horizon accountability.

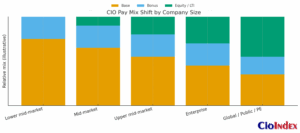

CIO Salary Benchmarks by Company Size

Company size provides the strongest starting point for benchmarking CIO compensation because it correlates with the factors that raise role difficulty: governance load, vendor scale, risk exposure, and integration demands. As organizations grow, the CIO remit often expands across platforms, geographies, and stakeholder expectations, widening the spread between base salary and total compensation.

Why Company Size Predicts CIO Pay So Well

Scale acts as a proxy for the pressures that shape CIO accountability:

- Governance intensity: increased board visibility, audit scrutiny, and stakeholder oversight

- Vendor and contract scale: larger strategic suppliers, higher concentration risk, more complex sourcing models

- Risk surface area: broader blast radius for outages, breaches, and third-party failures

- Integration load: acquisitions, divestitures, multi-ERP environments, fragmented data ecosystems

- Operating model complexity: federated structures, shared services, global delivery, follow-the-sun support

Size sets a baseline. Scope and mandate explain variance around that baseline.

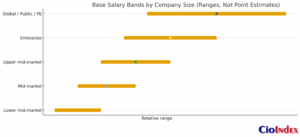

Suggested Benchmark Bands by Company Size

Benchmarking stays consistent when company size is expressed through a single lens. Revenue bands support cross-industry comparisons. Employee bands track operational complexity when headcount drives delivery scale.

| Company size band (revenue or employees) | Base salary range | Typical bonus target (% of base) | LTI/equity prevalence | Typical LTI weight | Scope triggers that push higher |

|---|---|---|---|---|---|

| Band 1 (small / lower mid-market) | [range] | [x%–y%] | None / Some | Low | First enterprise platforms, security uplift, key vendor consolidation |

| Band 2 (mid-market) | [range] | [x%–y%] | Some | Low–Med | Multi-site footprint, ERP/CRM scale, transformation portfolio emerges |

| Band 3 (upper mid-market / large) | [range] | [x%–y%] | Common | Med | Multi-region operations, heavier audit load, multi-SI delivery, active integration work |

| Band 4 (enterprise) | [range] | [x%–y%] | Common | Med–High | Regular board/audit exposure, cyber resilience accountability, modernization at scale |

| Band 5 (large enterprise / global) | [range] | [x%–y%] | Standard | High | Global footprint, high regulatory burden, critical uptime requirements, complex vendor/data ecosystems |

Interpretation principles

- Base ranges function as bands rather than point estimates.

- Bonus targets and LTI prevalence reflect pay design patterns that shift with scale.

- Scope triggers explain variance within the same size band.

What Changes as Size Increases

Scale changes the CIO role in three predictable ways:

The mandate expands from operational effectiveness to enterprise outcomes.

Smaller environments tend to reward service stability and cost discipline. Larger environments expect those outcomes while also delivering platform modernization, portfolio rationalization, and operating model change.

Board exposure rises, along with crisis accountability.

Major incidents escalate quickly in larger organizations. The role carries enterprise-level accountability for resilience, response readiness, and recovery performance.

Pay mix shifts from cash toward total compensation.

Smaller organizations often weight compensation toward base and annual incentive. Larger organizations—especially public companies and PE-backed environments—more often rely on long-term incentives to support retention and align pay with multi-year results.

Scope Factors That Move Pay Within the Same Size Band

Company size anchors the benchmark. These scope factors commonly move compensation toward the low end, midpoint, or top end of a band:

- Cyber accountability: direct ownership, shared ownership, or de facto accountability during incidents

- Data and AI mandate: platform ownership tied to measurable business outcomes

- Product and platform ownership: customer-facing platforms, enterprise platforms, shared services at scale

- Turnaround conditions: chronic delivery failure, high technical debt, visibility at the CEO/board level

- Post-merger integration: duplicated systems, fragmented data, complex ERP landscapes, vendor consolidation

Compensation tends to price toward the top of a band when board-level outcomes sit within the CIO’s remit: resilience posture, risk reduction, and transformation value realization.

Takeaways

- Aspiring CIO: Readiness for higher bands is signaled by transformation outcomes, governance fluency, vendor leadership at scale, and resilience accountability—not tenure alone.

- Current CIO: Scope-adjusted benchmarking relies on explicit proof: risk ownership, portfolio criticality, integration load, and enterprise platform responsibility.

- HR/Boards: Title-driven leveling misprices the role. Complexity, risk, and mandate should anchor compensation bands, with bonus and long-term incentives aligned to time horizon and accountability.

CIO Salary Benchmarks by Industry

Industry influences CIO compensation because it shapes the risk profile of technology decisions. Regulation, operational criticality, customer expectations, and legacy dependence change the stakes of outages, breaches, and failed transformations. As those stakes rise, governance demands increase—and compensation often follows.

Regulated vs Non-Regulated: The Pay Premium Logic

Regulated industries tend to price the CIO role differently for a straightforward reason: technology risk becomes enterprise risk. Regulatory exposure expands executive accountability in areas that frequently reach board and audit committee agendas:

- Security and privacy obligations: controls, audits, incident reporting, data handling expectations

- Resilience expectations: uptime requirements, recovery capability, operational continuity

- Third-party risk oversight: vendor concentration, supply chain exposure, contractual and control expectations

- Governance load: audit readiness, policy enforcement, evidence-based compliance, repeatable control performance

The “premium” is rarely a reward for compliance activity. It reflects the cost of failure and the executive burden required to sustain a defensible posture.

Industry Segments and CIO Pay Context

The CIO title appears across industries, but compensation comparisons need context because the scope and accountability profile change materially.

Financial services: High governance intensity, strong security and privacy requirements, and a risk posture that draws sustained board scrutiny. Vendor oversight and resilience expectations often increase role accountability.

Healthcare and life sciences: Sensitive data, complex compliance expectations, and environments that combine operational technology, clinical systems, and third-party ecosystems. Reliability and privacy carry high reputational and regulatory consequences.

Government and public sector: Compensation structures frequently differ from private-sector executive packages, with more constraints on incentives and long-term compensation. Role complexity can remain high due to legacy dependence, procurement models, and public accountability.

Manufacturing and industrial: Technology risk often extends into operational continuity through plant systems, supply chains, and operational technology integration. Cyber resilience and uptime can carry direct revenue and safety implications.

Retail and consumer: Customer experience and availability expectations tighten the tolerance for downtime. Digital channels, identity and payment ecosystems, and peak-period performance can place a premium on resilience and platform scalability.

Energy and utilities: Critical infrastructure operations, resilience requirements, and regulatory oversight shape risk exposure. Operational technology, safety implications, and continuity mandates frequently elevate executive accountability.

Technology and SaaS: Peer comparisons require care because titles split differently across organizations. Equivalent scope may sit with a CIO, CTO, VP Engineering, or Chief Product/Technology leader. Compensation often leans more heavily toward equity and long-term incentives, especially in growth environments.

Industry-Specific Factors That Move CIO Pay

Across industries, several recurring factors shift compensation expectations by changing the scope and risk profile of the role:

- Critical uptime and continuity requirements: tolerance for downtime, recovery expectations, operational dependence

- Data sensitivity and compliance intensity: privacy obligations, audit expectations, data governance maturity

- Legacy footprint and technical debt: modernization complexity, platform sprawl, integration constraints

- Customer-facing technology expectations: digital experience standards, performance during peak demand, reliability across channels

Industry sets the context; scope determines how much of that context sits directly within the CIO’s accountability.

Takeaways

- Aspiring CIO: Industry choice shapes both the pay model and the skills that command a premium. The strongest fit aligns personal strengths with the industry’s dominant risk and value drivers.

- Current CIO: Benchmarks hold up best within an industry peer set that matches regulatory burden, criticality, and operating model complexity.

- HR/Boards: Peer groups should reflect risk and complexity, not revenue alone. In many industries, governance load and operational criticality drive compensation more reliably than size comparisons.

Bonus Benchmarks: Targets, KPIs, and What Drives Payouts

Annual incentives carry more signal than base salary in many CIO packages because they reveal two things: what the organization values and how directly the CIO is held accountable for outcomes. Bonus plans also expose misalignment faster than any other compensation component—especially during large transformations or elevated risk periods.

Bonus Targets: How to Read “Threshold,” “Target,” and “Stretch”

Bonus plans typically define performance levels along a range:

- Threshold: minimum performance that triggers a payout, often reduced relative to target

- Target: performance that meets expectations; the bonus pays at the target level

- Stretch (or maximum): performance above plan; payout increases up to a defined cap

A useful benchmark distinction exists between the target percentage and the payout reality. Identical target percentages can produce very different outcomes depending on how much weight sits on corporate performance, how discretionary the scoring is, and whether targets reflect achievable conditions.

CIO bonuses tend to price higher when the role carries one or more of the following conditions:

- Turnaround context: chronic delivery problems, instability, or material technical debt

- Transformation dependency: business strategy tied directly to platform modernization and operating model change

- High-risk exposure: regulated sectors, critical infrastructure environments, high sensitivity data, heightened third-party risk

- Crisis readiness expectations: recovery capability treated as a board-level priority

These mandates often increase ‘cash at risk,’ reinforcing execution expectations and compensating for volatility in scope and accountability.

What CIOs Are Commonly Measured On

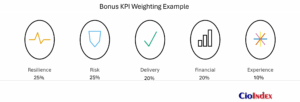

CIO scorecards vary, but most draw from five KPI families. Each KPI family rewards a different dimension of executive performance.

Reliability and resilience

- Availability and stability measures tied to critical services

- Incident reduction and severity reduction

- Recovery maturity: RTO/RPO targets, backup integrity, restoration performance

Cyber and risk

- Audit outcomes and remediation performance

- Maturity improvement tied to defined frameworks or internal control models

- Key control effectiveness and third-party risk posture

Delivery and execution

- Milestone outcomes and delivery predictability

- Benefits realization tied to the business case, not project completion

- Portfolio health: throughput, dependency management, risk closure rates

Financial management

- Run-rate reduction without service degradation

- Cloud unit economics, cost allocation maturity, FinOps discipline

- Vendor savings tied to contract outcomes and performance improvements

Experience and enablement

- Employee productivity enablement through platforms and workflows

- Customer journey enablement, especially where digital channels are core revenue drivers

- Adoption and value realization of enterprise tools, measured through outcomes

Strong CIO incentive design keeps the scorecard outcome-oriented: stability, risk posture, delivery value, and economics.

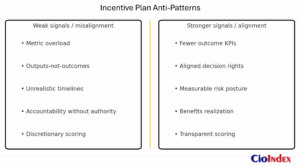

KPI Design Pitfalls That Distort Incentives

Bonus plans fail in predictable ways. These failures create weak signals for performance and encourage superficial compliance instead of durable outcomes.

- Metric overload: too many measures dilute accountability and reduce clarity

- Outputs replace outcomes: project milestones get rewarded even when benefits fail to materialize

- Time horizons conflict with reality: transformation metrics demand results faster than the organization can absorb change

- Accountability without authority: enterprise outcomes sit on the CIO scorecard without budget, staffing, or decision rights to influence the result

- Discretion replaces discipline: opaque scoring undermines trust and weakens the link between pay and performance

Incentives work best when the CIO is rewarded for outcomes that can be influenced directly, measured credibly, and sustained beyond a single review cycle.

Takeaways

- Aspiring CIO: Executive credibility in compensation discussions comes from measurable outcomes—resilience improvements, delivery value, and economics, not activity volume.

- Current CIO: KPI alignment matters as much as pay level. Incentives should reflect strategic priorities and decision rights, with outcome measures that hold up under scrutiny.

- HR/Boards: Incentives should reward value creation and risk reduction rather than project activity. A smaller set of outcome-based measures usually strengthens alignment and improves accountability.

Equity and Long-Term Incentives: When They Appear and How to Interpret Them

Long-term incentives (LTI) change the economics of CIO compensation. Base salary and annual bonus describe near-term cash. LTI shifts compensation toward retention and multi-year outcomes, often becoming the component that separates “competitive” packages from truly market-leading ones at enterprise scale.

When Equity Becomes Standard

Equity and other long-term incentives become more common as the organization’s scale and governance maturity increase. The strongest pattern appears in:

- Public companies: equity programs tend to be established and recurring, using standardized grant cycles and governance oversight.

- Large enterprises: retention needs increase as transformation portfolios grow and executive accountability expands.

- Private equity–backed companies: long-term incentives often tie leadership retention to value creation and an exit horizon.

- Late-stage growth organizations: equity becomes a primary lever for attracting and retaining executives during acceleration and scaling.

Smaller organizations may offer equity opportunistically, but it is less consistently structured and may not function as a stable benchmark component.

Common LTI Structures

LTI structures differ by company type, growth stage, and governance norms. The most common instruments follow.

RSUs (Restricted Stock Units)

- Deliver value through time-based vesting.

- Lower upside than options, higher certainty when compared at grant value.

- Common in public companies and mature enterprises.

Stock options

- Value depends on future appreciation, creating higher upside and higher risk.

- Common in growth environments and technology-heavy organizations.

Performance shares (often called PSUs)

- Vest based on multi-year performance outcomes (company performance or strategic metrics).

- Align incentives to longer-term results, but the design can become complex.

Retention grants

- Time-based awards intended to reduce flight risk during multi-year change.

- Most effective when paired with clear scope and credible performance expectations.

Private equity structures

- Rollover equity: equity carried into the new capital structure, aligning leaders with ownership outcomes.

- Profit interest (or similar instruments): value participation tied to enterprise value growth.

- Exit-based outcomes: realized value depends on timing, capital structure, and exit performance.

The instrument matters, but the governing logic matters more: retention, alignment, and time horizon.

Equity/LTI Instrument Comparison Table

Interpreting Equity Value Without Misleading Comparisons

Equity comparisons break down when “value” is treated as a single number. Three factors usually determine real economic impact.

Grant value vs realized value

Grant values represent estimates at the time of award. Realized value depends on vesting, price performance, and liquidity.

Vesting mechanics and refresh practices

- Vesting schedules shape the annualized value of an award.

- Cliffs delay vesting and raise retention pressure.

- Refresh grants can materially change long-term value, especially in public-company programs.

Concentration risk and liquidity realities

- Equity concentrates compensation into a single asset, raising risk.

- Liquidity differs sharply between public companies and private companies.

- Private equity outcomes can be attractive, but they are sensitive to capital structure and exit timing.

LTI is often the most misunderstood part of CIO pay. Clear interpretation requires separating headline award values from the conditions that determine whether value can be realized.

Takeaways

- Aspiring CIO: Equity literacy increases career earnings leverage. Understanding instruments, vesting, and liquidity changes how offers are evaluated and how career moves compound over time.

- Current CIO: LTI alignment should reflect multi-year transformation outcomes and risk accountability, not short-term optics. Terms matter as much as amounts.

- HR/Boards: LTI should retain and align, not compensate for an underpriced base role. Strong design connects pay to time horizon, accountability, and measurable outcomes.

What Profiles Command Premium Pay

CIO compensation rises fastest when the role moves from managing technology to shaping enterprise outcomes under material risk. Premium pay tends to follow candidates whose track record reduces uncertainty for boards: lower operational risk, faster value realization, stronger governance performance, and fewer surprises during transformation.

Capabilities That Typically Command a Premium

Cyber resilience leadership with board fluency

Security credibility alone is no longer differentiating; resilience leadership is. Premium profiles combine technical command with governance-grade communication: risk framing, control maturity, crisis readiness, and recovery capability. Confidence at board level often reflects disciplined operating routines, tested incident response, and measurable maturity improvement.

Cloud economics and vendor leverage

Cloud adoption rarely produces savings by default. Premium candidates show commercial strength: cost allocation discipline, unit economics, workload optimization, and contract negotiation that improves both cost and performance. Vendor leverage includes governance of large integrators and strategic suppliers, not just procurement outcomes.

Product operating models and cross-functional change leadership

Organizations pay for CIOs who can shift delivery from project throughput to product value: stable teams, clear ownership, measurable outcomes, and faster learning cycles. Premium profiles show the ability to change incentives and operating routines across technology and business teams without destabilizing operations.

Data and AI enablement with governance

Data and AI programs create value only when trust scales with speed. Premium profiles combine enablement with governance: data quality, stewardship, privacy controls, responsible AI practices, and adoption measured through outcomes. The differentiator is the ability to convert data and AI into repeatable business value while reducing model and compliance risk.

M&A integration and platform modernization at scale

Few mandates carry more complexity than integration and modernization at the same time. Premium candidates demonstrate repeatable patterns: consolidation roadmaps, dependency management, ERP rationalization, data integration, and stable operations through high-change periods. The market prices the ability to reduce integration drag and accelerate synergies.

Signals That Shape “Premium” Pricing Decisions

Premium compensation is rarely driven by credentials alone. Boards and HR typically price the candidate based on evidence that outcomes can be delivered under real constraints.

Transformation outcomes delivered

Delivered outcomes carry more weight than launched programs. Evidence includes benefits realization against business cases, material legacy reduction, measurable cycle-time improvement, and stable performance during change.

Crisis leadership and recovery performance

Major incidents test executive readiness. Signals include ransomware preparedness, practiced response routines, restoration performance, and credible communication under pressure. Recovery capability matters as much as prevention.

Talent development and operating model execution

Premium CIOs build capacity, not dependency. Signals include bench strength, leadership development, improved retention in critical roles, and an operating model that continues to perform when priorities shift.

Takeaways

- Aspiring CIO: Premium positioning comes from an outcome portfolio—resilience improvements, value delivered, and commercial results—rather than project volume.

- Current CIO: Premium narratives land best when framed in metrics and risk terms: value realization, resilience performance, governance outcomes, and reduced uncertainty.

- HR/Boards: Premium hires should be priced for outcomes. Validation requires evidence: delivered results, crisis performance, and operating model credibility—not buzzwords.

Negotiation and Offer Design

Compensation discussions succeed when they tie package design to mandate, scope, and governance reality. The goal differs by audience, but the underlying logic stays consistent: clarify accountability, align incentives to outcomes, and avoid structures that create predictable failure.

First-Time CIO Roles: Scope, Support, and Mandate Clarity

First CIO appointments often carry title and scope mismatch risk. The title signals executive accountability; the operating reality may not provide executive authority. Offer discussions should surface the practical foundations required to deliver results.

Title vs scope alignment

- Role definition tied to enterprise scope or functional scope

- Clear ownership boundaries where responsibilities span security, data, digital, or shared services

- Reporting line and decision rights, especially across business units

Support structure

- Budget authority aligned with accountability

- Team capacity and leadership coverage across infrastructure, applications, security, data, and delivery governance

- Vendor and partner model clarity, including integrator reliance and contract constraints

Mandate and success measures

- Run expectations defined alongside transformation expectations

- Outcome measures specified in business terms: resilience, risk posture, value realization, and financial discipline

- Time horizon aligned with organizational change capacity

Guardrails

- Transformation timelines that match complexity and dependency reality

- Resourcing assumptions tied to delivery outcomes rather than optimism

- Explicit treatment of inherited risk and technical debt

Re-Pricing Scope for Current CIOs

Scope expands faster than compensation structures. Re-benchmarking becomes credible when anchored in objective shifts in accountability, complexity, and enterprise risk.

Triggers that justify a compensation reset

- M&A integration scope expands materially

- Cybersecurity accountability increases, especially through board-level scrutiny

- Global footprint grows, driving governance and operational complexity

- Consolidation of technology functions adds span of control and delivery accountability

- Transformation portfolio becomes business-critical rather than incremental

Executive narrative that supports re-pricing

- Value creation linked to measurable outcomes: benefits realization, cycle-time reduction, platform consolidation impact

- Risk reduction framed in governance terms: resilience posture, audit outcomes, third-party risk improvements

- Operational performance maintained during change, supported by incident and stability trends

Pay mix strategy

- Base adjustments tied to expanded scope and market positioning

- Bonus design aligned with annual outcomes and decision rights

- LTI aligned with multi-year transformation value and retention needs

- Executive protections aligned with mandate volatility and risk exposure

HR and Boards: Competitive Packages With Governance Alignment

Package design must balance market competitiveness, internal equity, and governance discipline. Pay becomes defensible when role leveling reflects scope and incentives reflect outcomes.

Leveling framework

- Size, complexity, and mandate as the primary leveling inputs

- Explicit scope considerations: board exposure, cyber accountability, transformation dependency, integration load

- Consistent peer group construction within industry and risk profile

Pay mix guidelines by organization type

- Smaller organizations: heavier weighting toward base and annual incentive

- Larger and public organizations: stronger LTI presence to align multi-year outcomes and retention

- PE-backed environments: LTI structured around value creation and exit horizons

Change-in-control and severance considerations

- High-level terms aligned with executive risk, market norms, and governance expectations

- Clarity on triggers, definitions, and practical enforceability

- Separation of retention needs from performance accountability

Practical Benchmarking Worksheet

A CIO compensation benchmark holds up when it starts with role scope and then adjusts for risk, complexity, and mandate. The worksheet below translates those drivers into a consistent self-assessment that supports career decisions, compensation discussions, and governance-level pricing.

Role baseline: size and industry context

Company size band

- Revenue band or employee band (single standard)

- Geographic footprint: local, multi-region, global

Industry risk profile

- Regulatory intensity: low, moderate, high

- Operational criticality: standard enterprise systems vs mission-critical/always-on environments

- Data sensitivity: routine business data vs high-sensitivity personal/financial/health data

Baseline output: a size-and-industry starting point for the compensation band.

Scope and mandate: what the CIO is accountable for

Mandate type

- Run mandate emphasis: reliability, service levels, cost discipline

- Change mandate emphasis: modernization, digital enablement, operating model change

- Combined mandate: simultaneous stability and transformation delivery

Scope ownership

- Functions in remit: infrastructure, applications, enterprise architecture, PMO, security, data/analytics, product/digital, shared services

- IT budget: absolute size and complexity drivers (multi-vendor, outsourcing, multi-SI delivery)

- Vendor governance: strategic contracts, concentration risk, performance enforcement capability

Governance exposure

- Board and audit/risk committee interaction: frequency and depth

- Crisis accountability: incident response leadership, recovery readiness expectations

Scope output: a clear statement of span of control and governance-level accountability.

Adjustment factors: what moves compensation within a band

Each factor below typically shifts compensation toward the low end, midpoint, or top end of a benchmark band.

Transformation criticality

- Incremental improvement vs platform-level modernization

- Benefits realization dependency: desirable vs business-critical

- Delivery risk: low-to-moderate vs high dependency and integration load

Integration and complexity load

- M&A integration responsibility: none, occasional, continuous

- Core platform complexity: single ERP vs multi-ERP and fragmented enterprise architecture

- Data fragmentation and interoperability constraints

Risk posture burden

- Cyber accountability: shared support vs direct ownership during board scrutiny

- Third-party risk profile: low vs concentrated reliance on critical vendors

- Regulatory audit cadence and evidence burden

Adjustment output: a rationale for why compensation should sit lower, average, or upper within the baseline.

“Place the role” guidance: positioning within a benchmark band

Compensation typically prices toward the upper range of a size band when several of the following are present:

- Board-level cyber and resilience accountability

- Business-critical transformation portfolio with measurable value targets

- Material M&A integration or platform consolidation scope

- High regulatory intensity with audit-ready control expectations

- Large vendor ecosystem with strategic contracts and concentration risk

Compensation typically prices toward the lower-to-middle range when most of the following apply:

- Primary mandate is operational stability with limited transformation exposure

- Narrow span of control (limited ownership of security, data, digital/product)

- Lower regulatory intensity and smaller governance load

- Modest integration demands and simpler core platform landscape

Worksheet as a Table

Baseline

| Factor | Low | Med | High |

|---|---|---|---|

| Company size (revenue or headcount) | ☐ | ☐ | ☐ |

| Geographic footprint | ☐ | ☐ | ☐ |

| Industry risk / regulation | ☐ | ☐ | ☐ |

| Operational criticality (uptime requirements) | ☐ | ☐ | ☐ |

Scope and mandate

| Factor | Low | Med | High |

|---|---|---|---|

| Mandate balance (run vs change) | ☐ | ☐ | ☐ |

| Span of control (functions in remit) | ☐ | ☐ | ☐ |

| IT spend and vendor ecosystem complexity | ☐ | ☐ | ☐ |

| Board / audit committee exposure | ☐ | ☐ | ☐ |

Adjustment factors

| Factor | Low | Med | High |

|---|---|---|---|

| Transformation portfolio criticality | ☐ | ☐ | ☐ |

| Integration load (M&A, divestitures) | ☐ | ☐ | ☐ |

| Core platform complexity (ERP, data, integration) | ☐ | ☐ | ☐ |

| Cyber accountability / third-party risk | ☐ | ☐ | ☐ |

Place the role

| Signal | Lower | Mid | Upper |

|---|---|---|---|

| Board-level cyber and resilience accountability | ☐ | ☐ | ☐ |

| Business-critical transformation value targets | ☐ | ☐ | ☐ |

| Material integration load (M&A, consolidation) | ☐ | ☐ | ☐ |

| High regulatory and audit evidence burden | ☐ | ☐ | ☐ |

| Large vendor ecosystem and concentration risk | ☐ | ☐ | ☐ |

What to collect before negotiating or approving a compensation range

For candidates and incumbents

- Role scope statement: remit, decision rights, budget authority, reporting line

- Transformation inventory: portfolio size, criticality, value measures, delivery constraints

- Risk inventory: cyber posture expectations, recovery requirements, audit obligations

- Evidence of outcomes: stability metrics, risk reductions, benefits realized, financial impact

For HR and boards

- Peer set definition: industry, size lens, risk profile, operating model complexity

- Compensation lens clarity: base vs cash vs total compensation, and equity valuation approach

- Incentive design logic: outcomes, weighting, governance of scoring, decision-right alignment

- Executive protections summary: severance and change-in-control alignment with mandate volatility

This worksheet produces a defensible benchmark narrative: baseline band selection plus scope-based adjustments that explain why a CIO role prices where it does.

FAQ

How much do CIOs make on average—and why does “average” mislead?

“Average CIO pay” blends roles with different mandates, authority levels, and risk exposure. The title can refer to an operations-first leader in a smaller organization or an enterprise executive accountable for cyber resilience and transformation at scale. Those jobs price differently, and averages hide the spread. Benchmarks hold up better when anchored in company size, industry risk, and role scope.

What is a typical CIO bonus percentage?

Bonus targets are commonly expressed as a percentage of base salary and vary by organization scale, governance maturity, and mandate intensity. Plans often define threshold, target, and maximum payout levels, with corporate performance and individual scorecards influencing the final result. Turnarounds and high-risk environments tend to increase “cash at risk.” Bonus design matters as much as the headline percentage because it determines payout probability.

Do CIOs get equity?

Equity and other long-term incentives are common in public companies, large enterprises, private equity–backed environments, and late-stage growth organizations. The form varies—RSUs, options, performance shares, retention grants, or PE-specific structures such as rollover equity or profit interest. The economic value depends on vesting schedules and liquidity. Equity comparisons require separating grant values from realized values.

What matters more: company size or industry?

Company size is often the strongest baseline predictor because it tracks complexity, governance load, vendor scale, and integration demands. Industry then shapes the risk profile—especially through regulation, data sensitivity, and uptime expectations. Scope determines how much of that industry risk sits directly within the CIO’s accountability. Reliable benchmarks treat size as a starting point and use industry and scope to explain variance.

Does reporting to the CEO change compensation?

A CEO reporting line often signals broader enterprise mandate, higher visibility, and greater decision influence, which can affect role pricing. It can also increase accountability for cross-functional outcomes such as transformation value and risk posture. Compensation impact depends on whether the reporting line reflects real authority over budget, operating model, and enterprise priorities. The reporting line matters most when paired with expanded scope and board exposure.

How do remote roles affect CIO pay?

Remote and hybrid policies influence pay primarily through the employer’s compensation philosophy. Some organizations apply geo-based pay bands; others price executive roles nationally, especially when scope and accountability are enterprise-wide. Remote arrangements can also affect travel expectations, stakeholder management load, and incident-response readiness. Benchmarking works best when based on role scope and pay policy rather than location alone.

How should CIO compensation be benchmarked for a PE-backed company?

Private equity–backed compensation typically emphasizes value creation and retention over a defined time horizon. Benchmarking should separate cash compensation from equity-like instruments and evaluate the capital structure, vesting terms, and exit mechanics that drive realized value. Integration and modernization mandates often carry higher volatility, influencing incentive design and protections. Peer comparisons work best against similar PE-backed companies with comparable scale, leverage, and transformation intensity.

What’s the difference between CIO and CTO compensation?

The distinction often comes down to accountability: CIO roles commonly own enterprise technology services, platforms, governance, and risk posture, while CTO roles are more likely to own product engineering, architecture, and technical strategy for customer-facing offerings. In some organizations the titles overlap or are structured differently (CTO as the senior tech executive, CIO as internal IT leader). Compensation differences usually reflect market competition for product engineering talent and the prevalence of equity-heavy packages in product-led environments. Scope and business model determine which title carries the broader mandate and higher total compensation.

For more information on the role of the CIO read our Wiki Article on Chief Information Officer (CIO)