The Age of Perpetual Upheaval

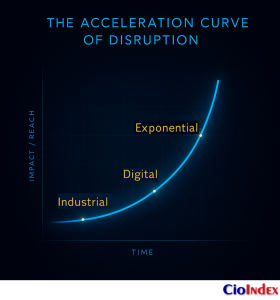

Business no longer moves in cycles; it moves in accelerations. Advantage erodes at the speed of information, and technologies once confined to prototypes now redraw entire markets within a single planning horizon. Competitors overtake incumbents not through size or legacy, but through code, data, and the capacity to redefine value itself.

This compression of time and consequence defines digital disruption—a condition in which exponential technologies, pervasive connectivity, and networked systems rewrite the terms of advantage. It is the moment when technological scale outpaces institutional adaptation.

Change has become recursive. Artificial intelligence optimizes automation; automation expands data; data trains algorithms that elevate the baseline of performance. Each advance accelerates the next, forming a self-reinforcing loop that transforms markets faster than governance can respond. Like gravity, disruption is unseen but constant—an invisible force shaping the trajectory of enterprise and the rhythm of competition.

A McKinsey Global Survey found that over eighty percent of chief executives expect digital disruption to reshape their industries within five years, yet fewer than one in five believe their organizations are prepared to meet it. Awareness exceeds capacity; foresight outpaces transformation. Institutions now see the horizon more clearly than they can move toward it.

Every system of management built for predictability now operates under conditions of perpetual uncertainty. Linear planning, incremental improvement, and defensive scale—all relics of industrial logic—struggle to survive in an economy defined by acceleration. The structures once designed to preserve advantage now constrain it.

Disruption is not a phase of change but the logic of the digital economy itself—the continuous reconfiguration of stability through motion.

Defining Digital Disruption — Beyond the Buzzword

Few terms in contemporary discourse are invoked more often yet understood less precisely than digital disruption. The phrase has become elastic enough to describe anything from technological novelty to existential collapse. Stripped of rhetoric, disruption is not a synonym for innovation; it is a structural realignment—a reordering of economic logic that changes how value is created, distributed, and defended.

What is Digital Disruption?

Digital disruption is the systemic reordering of value creation, delivery, and capture, triggered when digital technologies collapse the cost, time, and control boundaries that once defined entire industries.

Digital disruption occurs when new technologies and models alter the mechanics of competition itself. It emerges when digital systems collapse the boundaries of cost, time, and control that once defined industries. As marginal cost approaches zero and distribution becomes instantaneous, the architecture of value shifts. Production yields to participation, ownership to access, and scale to intelligence.

Every industrial revolution has introduced new tools; what distinguishes the digital one is the absence of friction. Software scales without replication. Data moves at light speed. Algorithms learn autonomously, reinforcing their own performance. As friction disappears, the economics of advantage invert—transaction costs fall, barriers to entry dissolve, and markets reorganize around those who orchestrate information rather than those who command assets.

Disruption reshapes value along three interdependent dimensions. Creation expands beyond the enterprise as users, partners, and algorithms become co-producers. Delivery evolves from ownership to continuous access, replacing product with experience. Capture migrates toward control of data flows and participation networks, concentrating value wherever learning accumulates fastest. Together, these dimensions redefine not only how value is made, but how it circulates, compounds, and endures.

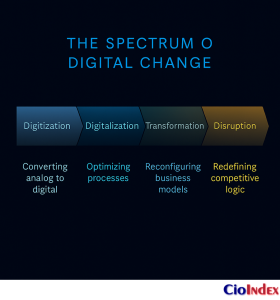

Placed within the spectrum of digital change:

- Digitization converts analog information into digital form.

- Digitalization enhances existing processes through digital tools.

- Digital transformation reconfigures models and culture to remain viable.

- Digital disruption overturns the competitive order itself—the logic through which industries create and distribute value.

Disruption, then, is not a managerial problem but an economic condition. It replaces continuity with recursion and efficiency with evolution. The disappearance of friction—economic, temporal, or cognitive—marks its arrival. When information moves faster than institutions can absorb or respond, disruption ceases to be an event; it becomes the environment.

Disruption is defined not by the appearance of new technology but by the disappearance of resistance.

The Economics and Dynamics of Disruption

The essence of digital disruption lies not in technology itself but in the economic transformation it provokes. When the cost of coordination collapses, information becomes infinite in its circulation, and distribution loses friction, the traditional foundations of competition dissolve. What once depended on scarcity now depends on abundance; what once rewarded control now rewards velocity. Advantage no longer arises from ownership or efficiency but from the ability to learn, adapt, and reconfigure faster than the environment that sustains it.

Industrial economics tethered value to marginal cost and finite capacity—constraints that digital systems neither recognize nor respect. Software scales without replication cost; cloud infrastructure converts fixed capital into elastic utility; algorithms improve through iteration, learning from every transaction to refine the next. As the cost of creation and coordination approaches zero, the logic of advantage inverts. Scale, once the guarantor of dominance, becomes the condition of rigidity. Intelligence, not size, becomes the currency of survival.

Industrial vs. Digital Economics

| Dimension | Industrial Economy | Digital Economy |

|---|---|---|

| Marginal Cost | Decreases slowly | Approaches zero |

| Scale | Physical | Networked |

| Value Driver | Efficiency | Learning |

| Competitive Edge | Ownership | Adaptation |

| Limiting Factor | Capital | Time |

This inversion transforms not merely how markets behave but what they reward. Industrial systems were designed to manage production; digital systems are designed to generate information. Data becomes the substrate of value—collected, refined, and recombined at speeds that outpace governance. Each transaction yields new data; each data point refines the next decision; each decision creates additional transactions. The cycle compounds until the system’s capacity to learn exceeds any single actor’s capacity to compete. The firm no longer sits at the center of value creation; it becomes one node within a self-learning network that perpetually recalibrates itself.

Network effects amplify this dynamic until growth ceases to resemble accumulation and begins to resemble acceleration. Every additional participant increases the utility of the system for all others, converting participation into momentum. Once the threshold of critical mass is reached, value begins to concentrate not around the largest producer, but around the fastest learner. Markets evolve into ecosystems governed by feedback loops—structures of continuous reinforcement where advantage compounds through the speed of adaptation.

These are not anomalies of the digital era; they are its anatomy. As the economy internalizes feedback and acceleration, time replaces capital as the ultimate constraint. Organizations fail not because they lack technology but because they continue to price time as if it were linear. When governance, budgeting, and planning are built for stability, they cannot survive environments defined by self-propelling change.

Traditional models of return, risk, and efficiency collapse under this velocity. Business cases expire before approval cycles conclude. Value creation becomes recursive: each success shortens the horizon of relevance. The assumptions that once ensured predictability now obstruct it. Industrial capital, bound to physical decay, diminishes with use; digital capital, bound to knowledge, increases through learning.

The economics of disruption are the economics of adaptation—where survival depends not on scale, but on the capacity to evolve before equilibrium returns. Permanence is an illusion and motion the only equilibrium.

The Anatomy of Disruption

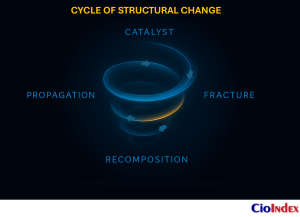

Disruption does not arrive as an event; it emerges as a pattern. What begins as a deviation inside the system matures into a logic that redefines it. Every period of stability carries within it the conditions of its own unraveling—feedback loops of technology, behavior, and economics that eventually exceed the assumptions that once held them together. The anatomy of disruption is, at its essence, the anatomy of renewal.

Each cycle follows a recognizable sequence of transformation, though not in time but in structure. It begins with a catalyst—a convergence of technological potential and market pressure that introduces new economics into an old system. The catalyst destabilizes equilibrium by lowering cost, expanding access, or redefining convenience. What appears at first as marginal innovation gradually alters the logic of value, forcing institutions to operate within a reality they did not design.

The catalyst gives rise to propagation—the amplification of the new logic through networks, markets, and behaviors. Digital systems accelerate this diffusion because they are designed to multiply, not scale. Each additional participant strengthens the new model rather than diluting it. Propagation is exponential, not additive; its momentum is driven less by adoption than by imitation. Once a critical mass of actors operates under the new cost structure, the incumbent system’s coherence begins to fracture.

Fracture marks the third condition—the point where legacy assumptions can no longer contain the dynamics they were built to regulate. Costs rise as margins compress, decision cycles lag as markets accelerate, and institutions mistake structural change for volatility. This is the silent phase of decline: performance remains measurable, but relevance erodes. The system continues to function even as its foundation disintegrates.

From fracture emerges recomposition—the reassembly of order under a new logic. New entrants define standards, new intermediaries manage flows of data and trust, and consumers recalibrate expectations to the rhythms of the new economy. Recomposition is not recovery; it is redefinition. The system stabilizes only to begin the process again, for every new order becomes the platform of its next disruption.

The anatomy of disruption is therefore cyclical but not repetitive. Each cycle accelerates because the infrastructure of the prior one becomes the substrate of the next. The steam engine made the factory possible; the factory made the network necessary; the network makes the algorithm inevitable. Every era inherits not just its tools but its momentum.

This dynamic blurs the boundary between stability and transformation. What once appeared as a crisis becomes the ordinary condition of progress. Disruption ceases to be the interruption of continuity and becomes its medium.

Every system evolves until the cost of its stability exceeds the cost of its reinvention. Disruption is the mechanism through which that balance is restored.

The Enterprise in Flux

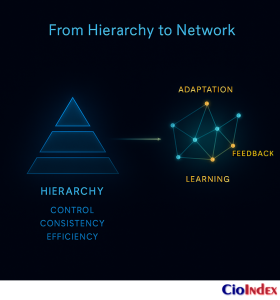

The modern enterprise exists in a state of permanent disequilibrium. The boundaries that once defined it—between inside and outside, firm and market, employee and algorithm—are dissolving. Digital disruption does not simply challenge organizational models; it dismantles the logic that sustained them. Institutions built to extract efficiency from repetition must now find advantage in reinvention.

The enterprise was once an instrument of control: it owned the assets, directed the labor, and managed the flow of information. Its purpose was to reduce uncertainty. Digital systems reverse that equation. They thrive on variation, feedback, and exchange. The organization ceases to be a closed mechanism and becomes an adaptive network—its intelligence distributed, its authority diffused, its boundaries porous by design.

As control fragments, advantage becomes relational rather than structural. Value arises not from what an enterprise possesses but from how it connects—across ecosystems, platforms, and communities of data. Partnerships replace ownership; participation supplants production. The firm no longer competes for territory but for relevance within the architectures of exchange that define its context.

This relational shift transforms the meaning of management itself. Planning yields to probability; coordination becomes algorithmic; decision-making evolves into a continuous process of calibration. Hierarchies designed for control now impede cognition, while governance reorients from enforcing alignment to enabling adaptation. Certainty, once the hallmark of authority, becomes a liability in a system where continuity depends on movement.

From structure to identity, the consequences deepen. Institutions grounded in predictability must learn to derive coherence from motion. Culture, once defined by shared routines, must become a system of shared learning. Strategy, once a map, becomes a living pattern—an evolving record of collective interpretation. The enterprise endures not by resisting change, but by transforming change into its organizing principle.

What emerges is less an organization than an organism: dynamic, permeable, and interdependent. Resilience reveals itself not as resistance to turbulence but as the ability to metabolize it. The enterprise that thrives in perpetual disruption does so by converting instability into intelligence—by allowing adaptation to become its core process rather than its emergency response.

The enterprise that survives disruption is not the one that controls change, but the one that becomes indistinguishable from it.

The Future of Stability

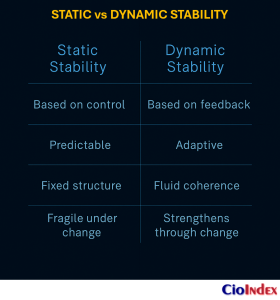

Every age mistakes its transformation for its crisis. What feels like disintegration is often reorganization; what appears chaotic is the emergence of a higher order still unrecognizable to the systems it displaces. Digital disruption, for all its volatility, is not the dissolution of stability but its reinvention. Stability endures, but it migrates—from the permanence of structures to the continuity of change itself.

For much of industrial history, stability was engineered through control: forecasts, hierarchies, and procedures that constrained variation in the name of efficiency. Predictability became synonymous with order. Yet in an economy defined by acceleration, control no longer produces stability—it suppresses adaptation. The pursuit of equilibrium through resistance merely guarantees obsolescence.

The new stability is kinetic. It emerges not from stillness but from coherence within movement. Systems that survive are those that organize around feedback rather than fixation. They achieve balance the way a cyclist does—by moving forward. Resilience becomes a dynamic state: the capacity to reconfigure faster than external conditions can impose irrelevance.

This redefinition alters more than the mechanics of enterprise; it reframes its philosophy. Strategy becomes less about forecasting the future and more about participating in its formation. Governance evolves from enforcing certainty to orchestrating learning. Leadership shifts from directing resources to shaping conditions in which intelligence can compound. Continuity is no longer a matter of control, but of consciousness—the awareness to sense change early enough to integrate it.

The redefinition of stability extends beyond mechanics into cognition. What endures in the digital age is not infrastructure but awareness—the ability to translate information into adaptation, and adaptation into design. Systems that survive are those that can perceive faster than they act, and act before perception decays into hindsight. The enduring advantage lies not in permanence but in perception: the capacity to remain coherent while everything else evolves.

Stability has not vanished; it has changed its form. It now lives in motion, coherence, and the ability to learn faster than the world transforms.

Disruption Across Industries

Although digital disruption operates according to universal economics, its expression varies with the density of regulation, the pace of feedback, and the rigidity of legacy systems. Each industry absorbs disruption through its own structure of inertia. The differences are of tempo, not of logic; the same dynamics that transform media and retail also reshape finance, healthcare, and manufacturing—only the speed of their surrender to new economics diverges.

Where information asymmetry defines advantage, transparency becomes the first fault line. Finance illustrates this shift with particular clarity: data once confined to institutional channels evolves into a public resource, and control migrates from intermediaries to interfaces. Liquidity organizes itself through participation rather than possession, collapsing the distance between producer and consumer. The capital market, long anchored in privileged access, reconstitutes around algorithmic visibility—where insight is instantaneous, and differentiation exists only in the moment before it spreads.

Where governance constrains behavior, disruption advances through interpretation rather than defiance. In domains like healthcare or energy, innovation cannot bypass oversight; it must translate it. The logic of permission evolves into the logic of possibility. As digital systems encode traceability, consent, and verification into their architecture, compliance ceases to represent friction and begins to serve as infrastructure. Regulation, once a brake on transformation, becomes the framework through which trust and transparency compound.

Where friction is physical, intelligence becomes material. In manufacturing and logistics, sensors, robotics, and additive design convert linear supply chains into self-learning ecosystems. Every object becomes a node within a network of feedback. Value migrates upstream into design, downstream into data, and inward into continuous optimization. Production ceases to be repetition; it becomes computation.

Where markets end and mandate begins, disruption redefines administration itself. In the public sector, change infiltrates through transparency rather than competition. When information becomes open and service becomes digital by default, governance starts to resemble a platform. The state evolves from enforcing procedure to orchestrating interaction; authority decentralizes without abandoning legitimacy, and efficiency acquires a new meaning—responsiveness.

Industry Response Matrix

| Domain | Friction Type | Disruptive Mechanism | New Logic of Value |

|---|---|---|---|

| Finance | Information asymmetry | Transparency & platforms | Speed of insight |

| Healthcare | Regulation | Embedded compliance | Trust as currency |

| Manufacturing | Physical friction | Intelligent production | Learning in motion |

| Public Sector | Bureaucratic inertia | Digital openness | Responsive governance |

Across every domain, disruption follows a single grammar: it redistributes control from center to edge, transforms knowledge into infrastructure, and converts scale into intelligence. The differences that remain are expressions of path dependency—how long institutions can postpone adaptation before the cost of preservation surpasses the cost of redesign.

Disruption does not target industries; it targets assumptions. What distinguishes sectors is not their exposure to change, but their capacity to unlearn the logic that once made them stable.

The Human Dimension of Disruption

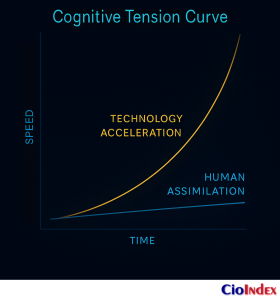

Every technological revolution is, at its core, a cognitive one. What changes first is not the machine but the mind that conceives it, and what resists longest is not infrastructure but identity. Digital disruption accelerates this tension to its limit: the rate of external change now exceeds the natural rhythm of human adaptation. Systems evolve exponentially; people evolve incrementally. Between those two tempos lies the friction that defines the modern condition.

The human cost of disruption is rarely visible in its economics but always evident in its psychology. Organizations describe resistance as cultural inertia, yet what they encounter is cognitive overload. When patterns of meaning collapse faster than they can be replaced, the mind instinctively retreats to familiarity. The result is not ignorance but exhaustion—a defensive adaptation to a world that updates faster than it can be understood.

Learning has become the primary form of labor. Competence no longer resides in what one knows, but in how quickly one can unlearn and recompose knowledge. The hierarchy of expertise flattens as access to information expands; authority shifts from possession to synthesis, from static mastery to dynamic interpretation. The measure of intelligence becomes agility—the ability to integrate new signals without losing coherence.

This shift transforms the social architecture of the enterprise. Collaboration becomes a cognitive network rather than an organizational chart. Decision-making disperses to the edges where information first appears. Trust migrates from role to relevance; credibility depends on contribution rather than title. The collective intelligence of the system rises or falls with its capacity to convert diversity into learning rather than fragmentation.

Emotion, long treated as peripheral to reason, becomes its stabilizing force. In an environment defined by volatility, empathy and psychological safety are not virtues but infrastructure—they anchor cognition amid acceleration. When change becomes perpetual, belonging becomes the only form of continuity. The culture capable of surviving disruption is one that transforms uncertainty into shared curiosity.

Consciousness remains the final frontier of disruption. Technology accelerates transformation, but meaning determines whether it coheres or collapses. The future of enterprise intelligence will depend less on the sophistication of its algorithms than on the adaptability of the minds that interpret them. The system can automate decision; only humanity can sustain understanding.

The real transformation is not digital but human—the migration of intelligence from the systems we build to the consciousness that must evolve to inhabit them.

The Geopolitics of Disruption

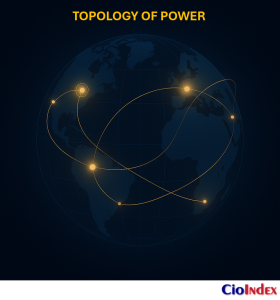

Power once resided in territory. It now resides in topology—the invisible networks that determine how information flows, where data accumulates, and who controls the means of computation. Digital disruption has redrawn the cartography of sovereignty: borders no longer define control; protocols do. Infrastructure, not geography, determines influence. Nations that once competed through industrial capacity now contest over platforms, standards, and algorithms.

What emerges is a new asymmetry of power—the geopolitics of code. States that design the architectures of interaction shape the behavior of those who inhabit them. Platforms, though nominally private, operate as instruments of soft sovereignty; their design decisions radiate outward as policy. A single line of code can regulate more effectively than a statute. The digital realm dissolves the boundary between governance and infrastructure, fusing economic design with political control.

Data becomes the new strategic resource—the substrate of both intelligence and dependence. Its collection grants insight; its accumulation grants leverage. The nation that governs the most data does not merely observe the world; it begins to simulate it. Predictive capacity becomes geopolitical currency, allowing influence to precede action. Surveillance and personalization, once commercial strategies, evolve into tools of statecraft.

Connectivity, once heralded as the universal equalizer, has become the new hierarchy. Networks do not democratize power; they concentrate it. The majority of global information traffic flows through a handful of companies and countries. The cloud, while immaterial in metaphor, has a geography of cables, satellites, and data centers—an empire built on latency and jurisdiction. Digital interdependence promises collaboration but enforces dependency.

This new landscape challenges the notion of sovereignty itself. Control no longer derives from borders or armies but from standards, encryption, and access. States defend not only territory but trust—citizen data, critical algorithms, and the integrity of digital infrastructure. Regulation becomes an act of geopolitical negotiation: every privacy law, every cybersecurity framework, every AI policy doubles as a declaration of independence in the digital realm.

As power migrates from land to logic, competition turns inward. Nations invest not merely in hardware or innovation but in ideology—the philosophies of openness, control, and governance that underwrite digital design. The geopolitical contest of the twenty-first century will not be fought over physical frontiers but over cognitive ones: the battle to define how societies perceive, process, and prioritize information.

Disruption has become the new diplomacy. The nations that master it will not only command technology but define the ethics and architectures through which the digital world evolves.

The Ethics of Acceleration

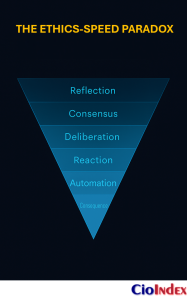

Every technological order is defined not only by what it enables, but by what it erases. Progress has always demanded trade-offs; digital acceleration merely compresses them. Decisions once separated by years now occur in milliseconds, leaving no time for moral deliberation to mature into consensus. The result is not amorality but temporal displacement—ethics lagging behind innovation by design.

Acceleration promises liberation: efficiency, intelligence, abundance. Yet every gain in speed diminishes reflection. When action outpaces understanding, responsibility becomes retrospective. The faster systems learn, the less time their creators have to ask what that learning serves. Optimization without orientation turns intelligence into entropy—a mechanism that magnifies its own momentum without regard for meaning.

The ethics of disruption therefore reside not in technology itself but in the velocity of change. Systems that update faster than institutions can interpret them create a deficit of accountability. Regulation becomes reactive, governance performative, and morality procedural. The question shifts from what is right to what is permissible under time. In the age of acceleration, constraint becomes the rarest form of wisdom.

This compression of consequence redefines the role of leadership. The moral frontier no longer lies in invention but in pacing—in the deliberate calibration of change to the threshold of comprehension. The ethical enterprise is the one that remembers why it innovates, not merely how. Restraint, once a limitation, becomes an instrument of design—a recognition that sustainability requires slowness somewhere in the system.

Acceleration also fractures collective experience. When reality updates unevenly, societies lose synchrony: institutions lag behind behavior, laws behind practice, and values behind possibility. The shared narrative that once gave coherence to progress disintegrates into parallel temporalities—the future distributed unequally across populations. Digital disruption, left ungoverned, risks becoming a form of temporal inequality.

Perspective becomes the final safeguard against acceleration. The question is no longer how fast systems can evolve, but how deeply societies can understand what evolution means. The measure of technological maturity is not velocity but awareness—the ability to innovate without severing continuity, to advance without forgetting what the advancement is for.

The greatest ethical act in an age of acceleration may be to pause—to create the stillness in which intention can once again overtake momentum.

From Disruption to Design

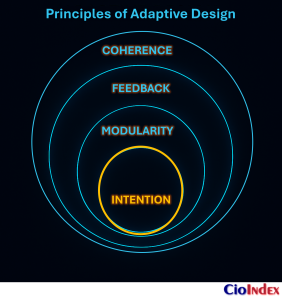

If disruption reveals the fragility of what was built for permanence, design restores coherence by building for change. The lesson of the digital age is not that systems fail, but that they fail in predictable ways—by confusing stability with strength and control with continuity. The task of design, therefore, is not to prevent disruption but to convert it into structure: to make evolution itself the organizing principle of order.

Traditional design sought equilibrium. It aimed to stabilize form against the pressures of time. Digital design seeks the opposite—to embed time within form, to create architectures capable of continuous self-adjustment. What begins as an engineering challenge becomes a philosophical one: how to create systems that remain coherent while never staying still.

Such systems are characterized not by rigidity but by rhythm. They operate through feedback loops, not fixed hierarchies; through modularity, not monoliths. Their intelligence lies in their permeability—the capacity to absorb disturbance and translate it into adaptation. Resilience ceases to mean endurance; it comes to mean responsiveness. The most stable structures are those designed to evolve without collapsing into chaos.

Design, in this sense, becomes a moral act. It encodes intention into infrastructure. Every algorithm, policy, or organizational process carries within it an assumption about the future: what kind of world it expects, and what kind it permits. To design well is to imagine responsibly—to construct systems that do not merely withstand change but dignify it, that allow innovation without abandoning interpretation.

The principles of adaptive design echo across disciplines. In architecture, it means flexibility of use; in technology, scalability without centralization; in governance, policies that learn as conditions shift. The essence is the same: structure as a living system. The designer’s role is no longer to fix form but to choreograph evolution—to define the boundaries within which emergence can occur safely and meaningfully.

Through this lens, leadership itself becomes an act of design. The leader’s task is not to impose order but to enable coherence—to ensure that systems remain intelligible as they transform. Vision is not a blueprint but a grammar: a way of maintaining sense as the language of progress changes.

Design completes the logic of disruption by turning reaction into creation. It transforms instability from a threat into a medium—the space where adaptation, intention, and meaning converge.

The Continuity of Change

Every system seeks equilibrium, but equilibrium itself has evolved. In the digital era, balance no longer means stillness; it means motion sustained by meaning—change that preserves coherence even as it alters form. Disruption, viewed through this lens, ceases to be a crisis and becomes continuity itself: the natural rhythm through which complex systems evolve, learn, and renew their relevance.

The pattern repeats across scales. Economies recalibrate as innovation redistributes power; organizations reconfigure as knowledge flows faster than control; individuals redefine themselves as learning becomes existence. What connects these levels is not technology but adaptation—the capacity to remain whole while becoming new. Continuity emerges not from resistance but from resonance, the harmony between structure and change.

The paradox of the digital age is that progress depends on preservation. What endures is not what resists transformation but what integrates it—values that guide behavior, purpose that outlives its tools, and understanding that remains intelligible even as its vocabulary evolves. To survive disruption is to embody time without being consumed by it.

Design, therefore, is not the end of disruption but its realization. It translates motion into meaning and transformation into intention. The systems that will endure are those that understand themselves as living—their identity continuous precisely because their form is not. The lesson of disruption is not to rebuild what was lost, but to learn to live inside what is always changing.

Continuity is not the absence of disruption but its mastery—the moment when transformation and stability become the same thing.