The Discipline of Constraint

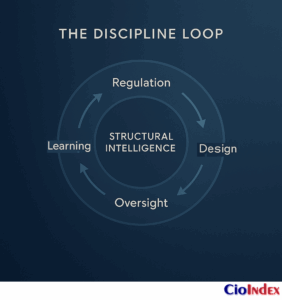

Every industry evolves through tension — between freedom and control, ambition and accountability. Digital transformation in regulated industries exposes a paradox at the center of progress: the stricter the boundary, the deeper the intelligence. Constraint, in these sectors, is not opposition to innovation but its discipline. Regulation compels design; oversight enforces clarity; scrutiny converts experimentation into structure. Where unregulated markets pursue freedom as advantage, regulated enterprises master endurance through precision — systems built to withstand examination become the ones that endure.

Regulation does more than restrict; it instructs. It translates principle into protocol and compliance into code. Every decision must be traceable, every algorithm explainable, every outcome defensible. Transformation here cannot depend on declaration; it must demonstrate integrity in motion. The result is not slower progress but structured adaptability — organizations that evolve coherently because their innovation is engineered for accountability.

This discipline reframes transformation itself. In open markets, change is expansion — more speed, more scale. In regulated industries, it becomes refinement — governance that anticipates, systems that justify, intelligence that sustains. What defines leadership is not acceleration but clarity of control: the ability to innovate within the rule rather than around it.

The architecture differs by domain.

- Finance turns governance into competitive intelligence — risk management elevated into predictive foresight.

- Healthcare builds ethics as infrastructure — ensuring that data acceleration never outpaces human dignity.

- Energy defines sustainability as system logic — aligning performance with planetary consequence.

Across these sectors, progress depends on equilibrium, not escalation. Regulation provides rhythm. It aligns ambition with accountability, innovation with integrity, and technology with trust. The signal of maturity is not disruption but durability — proof that an enterprise can evolve responsibly, continuously, and in full view.

This is the discipline of constraint: digital transformation as design, innovation as integrity, and progress that sustains legitimacy through the precision of its governance.

Finance — Governance as Competitive Intelligence

No industry displays the discipline of constraint more plainly than finance. The cost of error is systemic; the price of opacity is trust. Digital transformation in finance advances under constant scrutiny — every model examinable, every inference subject to challenge. Governance, once an external requirement, now operates as internal logic: the architecture where intelligence and accountability converge.

Banks and markets run within dense frameworks — Basel III, PSD2, DORA, GDPR — that define how data, risk, and control interact. What once appeared as overhead has matured into infrastructure. Leaders no longer treat regulation as burden; they treat it as blueprint. Code and governance develop together so that what is built can be trusted, and what is trusted can be proven.

Three structural shifts underpin this advantage.

Compliance becomes code.

Policy is embedded in workflow. Risk detection, capital adequacy, and lineage operate through real-time validation rather than retrospective audit. RegTech moves supervision from manual procedure to algorithmic discipline, creating predictive oversight — systems that sense deviation before exposure and learn from anomalies instead of recording them.

Data integrity becomes currency.

Trust travels at the pace of information across open-banking platforms and API ecosystems. Value resides less in data volume than in verifiability. Institutions that prove origin, consent, and usage transparency earn regulatory confidence and market preference. Governance is measured in explainability — the clarity with which a model justifies a decision when confronted by auditor or algorithm.

Governance becomes intelligence.

Risk management shifts from defensive perimeter to strategic differentiator. Models trained on stress patterns feed scenario forecasting, liquidity optimization, and portfolio construction. Oversight sits inside the feedback loop — not a gate at the end, but a control layer woven through operations. The enterprise learns as it complies.

This operating architecture changes the role of control. Governance is not a brake; it is the mechanism that sustains agility. Institutions that encode principles into platforms work with structural clarity — each line of logic traceable to ethical and economic intent. The strength of this system lies in its transparency. Financial technology operates in an environment that cannot tolerate opacity. The same rigor that ensures control also reveals fragility when governance turns superficial.

Regulatory theater remains the recurring failure — performing compliance without conviction. When oversight becomes optics, the organization forfeits the intelligence the system was designed to preserve.

Leaders illustrate a different rhythm: continuous governance dashboards that link risk signals to design decisions, agile frameworks that pair experimentation with auditability. Advantage emerges from tempo — the cadence at which oversight informs adaptation. Every regulatory update becomes a design challenge; every constraint, a refinement of structure.

Metrics reflect this discipline:

- Decision velocity: time from signal to executive action.

- Trust incidents per million transactions: reliability measured as precisely as return.

- Return on Trust (RoT): compounded value of transparency across customer, regulator, and ecosystem relationships.

Table 1: Financial Governance Metrics

| Metric | Description | Purpose |

|---|---|---|

| Decision Velocity | Time from signal to action | Measures responsiveness |

| Trust Incidents / Million Transactions | Operational reliability | Quantifies transparency |

| Return on Trust (RoT) | Compound value of transparency | Evaluates systemic confidence |

Financial governance now functions as cognition. It interprets uncertainty faster than markets, turning scrutiny into foresight. The regulated enterprise does not avoid complexity; it learns through it. Its intelligence is not only digital — it is governed by design.

Healthcare — Designing for Ethical Velocity

Few domains test the ethics of digital transformation as rigorously as healthcare. Here, every line of code carries moral weight. A misstep does not simply affect efficiency; it alters the conditions of care. Digital transformation in healthcare unfolds under the tension between acceleration and assurance — between the drive to save time and the duty to preserve trust.

The transformation of healthcare systems is not defined by the quantity of data they collect but by the integrity with which they use it. Electronic health records, diagnostic AI, and genomic platforms have expanded the perimeter of intelligence while compressing the space for error. Speed now amplifies consequence: what improves precision can also magnify bias. Progress depends on whether ethics can move as fast as data.

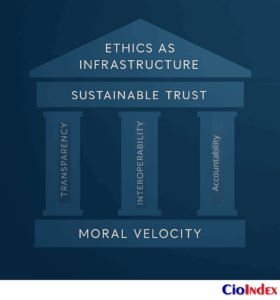

Ethics in healthcare is no longer an external review step; it has become infrastructure — a control system for moral velocity. Consent, explainability, and equity must be engineered directly into process design. The technical challenge is architectural: to build systems that can justify their reasoning at the pace they execute it. The cultural challenge is behavioral: to ensure that clinicians, data scientists, and technologists share accountability for what those systems learn.

Its logic unfolds across three dimensions of change.

Transparency replaces protectionism.

For decades, privacy meant keeping data sealed. Today, safety depends on traceability — the ability to follow a decision back through every dataset and parameter. Hospitals and research networks that expose provenance, bias testing, and algorithmic logic build confidence faster than those that conceal complexity behind proprietary walls.

Interoperability becomes empathy.

Fragmented systems produce fragmented care. Standards such as HL7 FHIR and cross-institution APIs have begun to reconnect clinical, operational, and research domains. Each connection is more than technical alignment; it is an act of empathy — a recognition that the patient’s story should move freely even when institutions compete. When systems communicate, trust follows.

Accountability becomes adaptive.

Ethical oversight cannot wait for annual review cycles. Machine-learning models evolve daily; governance must match their tempo. Continuous validation, bias monitoring, and safety dashboards transform compliance from a static audit into a living feedback loop. Oversight becomes dynamic — learning as the system learns.

These dimensions redefine how leadership measures responsibility. Boards and chief medical officers now track ethical agility — the time between detecting bias and correcting it — as closely as clinical outcomes. Regulators assess explainability with the same seriousness as efficacy. In advanced institutions, ethics committees work beside data-engineering teams, merging governance with design.

When ethics is engineered, transformation becomes sustainable. Without it, innovation deteriorates into noise — an accumulation of technology detached from purpose. Ethics-washing — the appearance of virtue without verification — remains the sector’s most corrosive failure. Each unexamined model erodes collective confidence, turning progress into paradox.

Evidence from leaders such as Mayo Clinic and DBS HealthTech shows that cultural design determines success more than technical novelty. Their governance frameworks embed accountability metrics into workflow: bias-alert cycles, consent-renewal prompts, and outcome-equity dashboards. The system does not rely on reminders; it behaves ethically by default.

Measurement in this context extends beyond efficiency.

- Ethical Agility Index: time to detect, disclose, and resolve algorithmic bias.

- Trust Continuity Rate: patient-consent retention across digital touchpoints.

- Feedback Velocity: how quickly adverse-event data reshape design.

Each indicator captures the same idea: ethics is not a statement but a speed. The healthcare enterprise that learns ethically learns fast.

Table 2: Ethical Performance Indicators

| Metric | Description | Frequency |

|---|---|---|

| Ethical Agility Index | Time to detect and resolve bias | Continuous |

| Trust Continuity Rate | Retention of consent across systems | Quarterly |

| Feedback Velocity | Incorporation of outcome data | Real-time |

Digital transformation in healthcare therefore advances through conscience as much as capability. The sector’s true innovation is not intelligent diagnosis but moral continuity — the assurance that technology can think rapidly without forgetting why it exists. Intelligence extends care only when it amplifies empathy. The most advanced systems prove progress not by how much they know, but by how faithfully they remember the human at the center of it.

Energy — Sustainability as System Intelligence

Energy enterprises operate at the intersection of technology, environment, and society — a nexus where performance, regulation, and responsibility must coexist. Digital transformation in energy extends beyond modernization of grids and infrastructure; it redefines how systems balance resilience with renewal. Sustainability has moved from aspiration to architecture, functioning as the intelligence that unites economic logic with ecological stability.

The sector’s complexity is structural. Grids span continents, supply chains interlace industries, and every operational decision now carries environmental consequence. Decarbonization targets, emissions reporting, and cyber-resilience mandates impose constraints that mirror those of finance and healthcare but with broader temporal stakes. Each watt, transaction, and data signal participates in the same accountability loop: optimize today, sustain tomorrow.

Digitalization made energy systems efficient; intelligence is making them adaptive. Predictive analytics, IoT telemetry, and AI-driven optimization now govern everything from grid stability to asset performance. The challenge is not sensing more but synthesizing better — turning fragmented data into actionable foresight without fracturing control. As technology fuses with ecology, sustainability becomes both outcome and operating system.

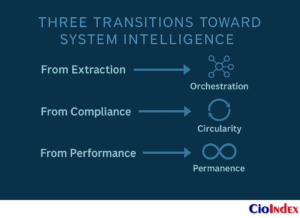

Three transitions now define how sustainability becomes intelligence.

From extraction to orchestration.

Traditional energy models maximized output through control of resources; digital systems maximize resilience through coordination of networks. Smart grids, distributed energy resources, and virtual power plants convert energy production into ecosystem orchestration. Value shifts from consumption to connection — from owning assets to harmonizing flows. Control gives way to choreography.

From compliance to circularity.

Regulation once dictated minimum standards of environmental performance; now it drives continuous regeneration. Carbon accounting, ESG disclosures, and lifecycle analytics embed sustainability into the feedback loops of investment and operation. Enterprises no longer manage waste — they design against it. The discipline of reporting becomes a mechanism of redesign, turning oversight into renewal.

From performance to permanence.

Efficiency metrics once defined success; now endurance does. Predictive maintenance, autonomous inspection, and climate modeling create self-correcting infrastructures capable of adapting under stress. The new ambition is not maximum output but sustained balance — systems that preserve capacity under volatility and recover faster after disruption. The measure of progress is continuity.

These transitions alter the cultural fabric of the energy enterprise. Engineering precision now shares authority with ecological literacy. Teams that once optimized kilowatts now design carbon intelligence — integrating environmental data directly into operational logic. Sustainability officers work beside data architects; resilience analysts share dashboards with plant operators. The enterprise becomes a living coordination of human and planetary systems.

Measurement reflects this convergence.

- Resilience Quotient: ratio of recovery speed to disruption frequency.

- Sustainability Feedback Velocity: time for environmental data to inform operational decisions.

- Carbon Intelligence Index: degree of emissions integration within performance dashboards.

Each metric expresses a single idea: continuity is now the highest form of efficiency. The energy enterprise that learns sustainably learns indefinitely.

Table 3: Sustainability Intelligence Metrics

| Metric | Definition | Objective |

|---|---|---|

| Resilience Quotient | Recovery speed ÷ disruption frequency | Operational continuity |

| Sustainability Feedback Velocity | Time for ecological data to influence operations | Adaptability |

| Carbon Intelligence Index | Integration of emissions into performance data | Traceable accountability |

The shift toward system intelligence transforms how energy is governed, financed, and understood. The sector’s leaders — from Ørsted’s reinvention into a renewable platform to Schneider Electric’s digital twin ecosystems — illustrate a new kind of maturity: progress verified by traceability. The same precision that financial systems apply to risk, and healthcare systems apply to ethics, the energy sector now applies to existence itself.

Digital transformation in energy is no longer a technological project; it is an ecological covenant — an agreement between innovation and endurance. Sustainability, once the language of compliance, has become the grammar of survival.

The Triangular Architecture of Responsibility

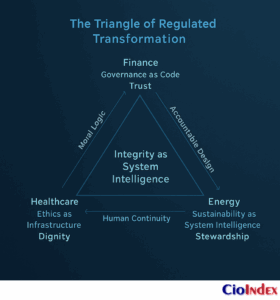

Finance, healthcare, and energy operate under different rules, yet their digital transformations follow the same geometry: each converts constraint into intelligence.

Where finance encodes trust, healthcare engineers ethics, and energy institutionalizes sustainability, all three converge around a single discipline — the governance of consequence.

This convergence reveals a triangular architecture of responsibility, a structure where each vertex expresses a distinct capability and a shared dependence. Finance governs the flow of capital and risk; healthcare governs the flow of data and dignity; energy governs the flow of resources and resilience. Together they form an integrated system — trust, ethics, and sustainability functioning as interdependent circuits of accountability.

At one vertex lies governance as code — finance’s translation of oversight into algorithmic precision.

At another stands ethics as infrastructure — healthcare’s fusion of intelligence with moral design.

At the third rests sustainability as system intelligence — energy’s embodiment of continuity through learning.

Each represents a different expression of the same principle: progress endures only when integrity is engineered into operation.

The interdependence among these architectures is becoming visible.

Financial institutions now assess climate risk and social impact alongside credit exposure, importing sustainability into the logic of governance.

Healthcare systems adopt AI assurance frameworks derived from financial compliance models, transforming ethics from qualitative aspiration into quantitative discipline.

Energy enterprises align their reporting structures with both financial audit and clinical safety models, treating transparency as the universal regulator.

These cross-influences illustrate a deeper pattern: regulation is evolving from domain-specific rule sets into a shared language of legitimacy.

When governance learns from ethics, and ethics learns from sustainability, compliance ceases to be constraint — it becomes cognition. The system begins to think as a whole.

To visualize this integration, consider the triangle as an adaptive circuit:

| Vertex | Core Discipline | Governing Logic | Structural Risk | Defining Metric |

|---|---|---|---|---|

| Finance | Governance as Code | Trust through verification | Regulatory Theater | Return on Trust (RoT) |

| Healthcare | Ethics as Infrastructure | Conscience in motion | Ethics-Washing | Ethical Agility Index |

| Energy | Sustainability as System Intelligence | Continuity through feedback | Greenwashing | Carbon Intelligence Index |

Each vertex contributes a stabilizing force; each risks collapse when responsibility becomes performance.

When finance performs compliance rather than embodies it; trust erodes.

When healthcare performs empathy without transparency; ethics dissolves.

When energy performs stewardship without accountability; sustainability fragments.

Integrity is the only equilibrium.

The comparative insight is not sameness but symmetry. Each domain must harmonize three flows:

-

Information flow — the traceability of data, decision, and intent.

-

Responsibility flow — the continuity between design and consequence.

-

Learning flow — the capacity to refine judgment through feedback.

Organizations that align these flows create integrity gradients — systems that self-correct as they scale. Those that fail to synchronize them regress into compliance theater, where accountability is reported faster than it is understood.

In this triangular architecture, regulation functions as connective tissue, not perimeter. It distributes intelligence rather than restricting it.

The future of digital transformation in regulated industries lies in how well enterprises can move information, responsibility, and learning through this geometry — translating oversight into awareness and awareness into action.

Integrity, in this context, is not a virtue; it is a design property. It is the condition that allows innovation to remain transparent, ethics to remain operative, and sustainability to remain measurable.

The triangle holds not because its sides are equal, but because its tensions are aligned.

Convergence — Regulation as Design Language

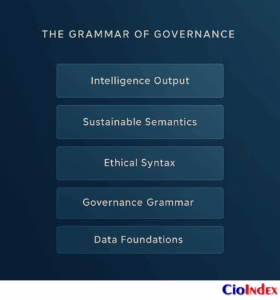

Across finance, healthcare, and energy, regulation is no longer an external constraint. It has become an architectural grammar — the set of design rules through which intelligence organizes itself. Where compliance once meant adherence, it now means comprehension. Enterprises have begun to treat oversight as a system property: embedded, measurable, and continuous.

This convergence transforms how organizations think, not just how they operate. Governance, ethics, and sustainability are no longer separate disciplines; they are dialects of the same language — a syntax of responsibility that allows systems to translate trust across domains. In this new grammar, traceability replaces opacity, explainability replaces assumption, and alignment replaces acceleration as the true metric of progress.

Digital transformation in regulated industries has reached a point where regulation itself has become code. Financial institutions design controls that execute autonomously; healthcare systems configure ethical parameters into algorithms; energy enterprises model sustainability through machine logic. Each industry encodes its moral framework into its operational systems, allowing accountability to travel at the same speed as innovation.

This redefinition has given rise to a class of cross-sector platforms where governance is computational. AI governance frameworks monitor model bias and compliance across banking, insurance, and healthcare simultaneously. RegTech ecosystems handle privacy assurance, sustainability metrics, and audit trails through unified data architectures. What began as regulatory convergence has evolved into governance interoperability — institutions learning to share their mechanisms of integrity as readily as they share APIs.

The implications reach the level of architecture. Enterprises are beginning to design with responsibility as default. Ethical, environmental, and financial controls are now conceived as foundational layers, not appended features. Security and transparency are engineered into algorithms the way infrastructure engineers once embedded electricity or water flow. The system does not simply meet regulation; it expresses it — every decision carrying its own justification.

This shift redefines agility. Traditional speed emphasized execution; regulated agility emphasizes translation — the speed at which insight becomes accountable action. Decision velocity, ethical agility, and sustainability feedback have converged into one rhythm of governance. Regulation, once reactive, now functions as sensor: detecting, signaling, and recalibrating the enterprise in real time.

The leaders of this convergence share one trait — architectural literacy. They design organizations the way cities are designed: with zoning for safety, pathways for data, and public spaces for trust. Their systems embody restraint without rigidity, creativity without chaos. They view compliance not as a checklist but as a pattern language — a set of design constraints that generate structure, coherence, and meaning.

The trajectory is clear. Finance taught enterprises how to quantify trust; healthcare taught them how to operationalize ethics; energy is teaching them how to sustain continuity. Together they are inventing a universal architecture of governance — regulation as design, oversight as intelligence, and accountability as the connective tissue of transformation.

Regulation, once the brake on innovation, has become its syntax. It gives structure to velocity, purpose to automation, and meaning to data. The most advanced enterprises no longer interpret rules; they design with them — transforming compliance into creativity, and governance into the grammar of enduring intelligence.

The Shadow Side — When Compliance Outruns Consciousness

Every system built for responsibility carries the risk of inversion. When governance accelerates faster than understanding, oversight turns into reflex rather than reflection. Digital transformation in regulated industries now confronts this paradox: the same architectures designed to enforce integrity can also conceal it.

The danger is not dramatic but structural. Enterprises that master compliance often begin to mistake validation for virtue. Dashboards glow with metrics of conformity — decisions logged, incidents resolved, reports filed — while the deeper work of judgment recedes beneath the surface. Automation makes compliance visible, yet visibility is not the same as vigilance. A system can record accountability without ever practicing it; an organization can obey every rule and still lose its reason for existing.

This erosion manifests through recurring pathologies that differ in form but share a common logic — the substitution of appearance for understanding.

The spectacle of compliance.

When governance becomes choreography, reporting replaces reflection. Enterprises design for audit rather than accountability, optimizing to satisfy inspection rather than to improve behavior. Data becomes curated for optics rather than for insight, until the system measures its own image and mistakes it for progress.

Ethics-washing.

As ethical governance gains visibility, its language spreads faster than its practice. Mission statements multiply while mechanisms stagnate. AI models are labeled “responsible” even as their training data remains opaque, and principles of fairness remain untested. The vocabulary of conscience becomes a mask for inertia — a failure born not of malice but of abstraction.

Greenwashing.

Sustainability metrics can follow the same pattern. Enterprises publicize offsets while deferring structural change, measuring emissions to demonstrate control rather than transformation. The feedback loops that should drive renewal collapse into self-congratulation, converting sustainability from design principle into marketing posture.

These distortions emerge whenever compliance detaches from consciousness. When governance systems scale faster than the cultures that sustain them, intelligence fragments; rules outpace reason, and algorithms outlearn accountability. Technology deprived of reflection becomes its own justification — flawless in operation, hollow in purpose.

Correcting this drift requires restoring proportion between automation and awareness. Controls must not only execute but explain, metrics must not only report but teach, and governance must not only verify behavior but shape belief — reminding institutions that accountability is a moral architecture as well as a digital one.

Some organizations are beginning to slow their systems enough to think. They pair algorithmic audits with human deliberation, introducing friction where it produces understanding. They rotate oversight roles so that specialization does not dull scrutiny, and they couple quantitative compliance data with qualitative ethics reviews, forcing numbers and narratives into the same conversation. These interventions interrupt efficiency just long enough for comprehension to reenter the loop.

The balance between compliance and consciousness determines whether regulation remains design or devolves into ritual. Integrity cannot be programmed once; it must be rehearsed continuously. Governance loses meaning the moment it ceases to require attention.

The greatest risk of digital transformation in regulated industries is not failure of control but failure of comprehension — a future where governance performs flawlessly and no one remembers why.

Measuring Integrity — From Scorecards to System Awareness

After governance becomes design and compliance becomes choreography, the remaining question is how integrity itself is measured. Digital transformation has taught enterprises to quantify almost everything—velocity, throughput, resilience—but the essence of responsible progress lies in what cannot be reduced so easily. The next stage of transformation is not faster measurement; it is smarter awareness.

Traditional metrics express compliance, not comprehension. They reveal what happened, seldom why. Scorecards count incidents, reports, and exceptions; they track activity, not alignment. When measurement becomes an end in itself, systems start performing for indicators rather than for outcomes. True evaluation must therefore evolve from enumeration to interpretation—from numeric trace to systemic meaning.

Integrity measurement begins when data behaves as dialogue. Instead of asking what occurred, mature systems learn to ask what the pattern reveals. Dashboards become mirrors that teach as they report, coupling precision with perception. This shift converts oversight from a retrospective exercise into a continuous exchange between information and intent.

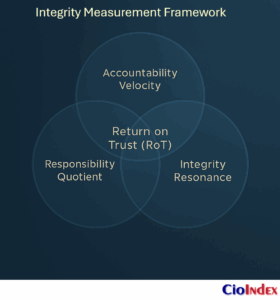

To capture that exchange, a new measurement architecture is emerging—one built on three interlocking dimensions.

Accountability velocity gauges how quickly an enterprise converts awareness into correction. It measures the time between detection and decision, highlighting responsiveness rather than volume of control. The faster integrity loops close, the more adaptive the organization becomes.

Responsibility quotient (RQ) reflects how evenly governance, ethics, and sustainability distribute through operations. It assesses proportionality—whether trust, care, and stewardship share the same weight as efficiency. High RQ indicates that accountability has become cultural rather than procedural.

Integrity resonance measures coherence: how consistently a system’s values propagate across its functions. It observes whether the same principles guide investment decisions, data practices, and environmental actions. When resonance weakens, integrity fragments; when it strengthens, transformation becomes self-reinforcing.

Together these dimensions form the foundation of Return on Trust (RoT)—a logic that replaces output metrics with relationship metrics. RoT evaluates transformation not by scale of activity but by durability of confidence across stakeholders. It is the compound interest of credibility.

Table 4: Example Measurement Dashboard

| Dimension | Indicator | Source | Frequency |

|---|---|---|---|

| Accountability Velocity | Detection → Decision time | Compliance logs | Continuous |

| Responsibility Quotient | Balance of governance/ethics/sustainability | Organizational survey | Quarterly |

| Integrity Resonance | Value alignment across functions | Cultural audit | Annual |

This approach demands a new kind of instrumentation. Dashboards must merge quantitative and qualitative signals, presenting compliance data beside narrative context. Risk systems must integrate behavioral indicators that track decision patterns rather than discrete breaches. Cultural sensors—surveys, sentiment analyses, and ethical audits—must feed the same intelligence graph as financial and operational data. Measurement, in this model, becomes a form of listening.

The discipline of integrity measurement also requires transparency about uncertainty. Not every variable can be standardized, and not every signal should be automated. Judgment remains the ultimate metric—the human calibration that keeps governance from becoming algorithmic dogma. When organizations measure reflection as deliberately as they measure response, awareness becomes a strategic asset.

The most advanced enterprises now treat measurement as consciousness in motion. Finance uses continuous validation loops that expose anomalies before impact; healthcare couples bias detection with patient-trust indices; energy tracks the rhythm between emissions data and operational change. Each domain, in its own vocabulary, has begun to translate accountability into intelligence.

Integrity cannot be proven by precision alone. It must be experienced through coherence—the alignment of data, design, and decision. When measurement rises to that level, governance evolves into guidance, and systems begin to sense their own ethics.

Integrity in Motion

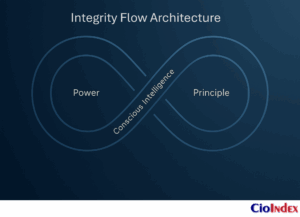

The end of transformation is not efficiency but awareness. When technology, governance, and conscience finally converge, the enterprise stops asking how to comply and begins asking how to contribute. This is where digital transformation in regulated industries leads — toward a form of intelligence measured not by capability but by character.

What began as compliance has evolved into consciousness. Regulation taught systems to explain themselves; ethics taught them to listen; sustainability taught them to endure. Together, these disciplines have created a new institution — one that governs through understanding rather than enforcement. Its intelligence is neither mechanical nor moral alone, but relational: an awareness distributed through every decision, every model, every outcome.

The next horizon of responsibility lies beyond alignment; it lies in participation. As systems grow self-regulating, the role of leadership shifts from control to calibration — maintaining proportion between automation and empathy, between what can be done and what should. Governance becomes stewardship, not surveillance. The regulated enterprise learns to act as citizen: accountable to ecosystems, not just economies.

Integrity, in this sense, is movement — the circulation of purpose through complexity. It is what allows a financial platform to manage risk without amplifying it, a healthcare system to automate care without depersonalizing it, an energy network to balance supply without depleting the planet. Integrity moves through these systems as current through a circuit — invisible, essential, defining.

Enterprises that sustain this current will outlast those that chase momentum. They will measure success not by the speed of transformation but by the stability of trust — by how reliably their intelligence produces fairness, safety, and meaning. Their innovation will not be what they automate, but what they preserve.

The long arc of digital transformation bends toward coherence: technology serving governance, governance serving humanity. Integrity in motion is that arc realized — a living equilibrium between power and principle. Enterprises that master it will do more than meet the standards of their time; they will help shape the ethics of the one that follows.