The Paradox of Digital Value

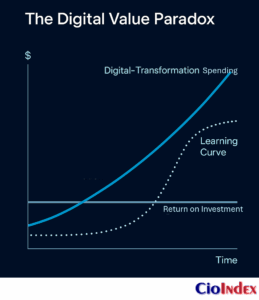

Digital transformation was meant to make enterprises leaner, faster, and smarter. For many organizations, it has instead become a paradox of scale: the more they invest, the harder it becomes to see a measurable return.

Global spending on digital transformation is projected to surpass $2.5 trillion by 2025 (IDC). Cloud migrations, AI pilots, and platform modernizations absorb record budgets—yet fewer than half of enterprises report positive ROI within three years. The promise of efficiency often precedes a new kind of complexity: cost structures change long before benefits appear. Transformation costs accelerate faster than value can materialize — a capital lag that exposes how poorly conventional ROI models account for learning and adaptation. The paradox isn’t technological — it’s economic. Transformation efforts falter when governed as expenses rather than as adaptive portfolios of value.

The first wave of transformation unfolded during an era of cheap capital and high liquidity. Investments in data platforms, AI capabilities, and cloud expansion were justified by long-term potential rather than near-term returns. With capital now constrained and scrutiny intensified, transformation investments must prove their economic logic, not just their strategic intent.

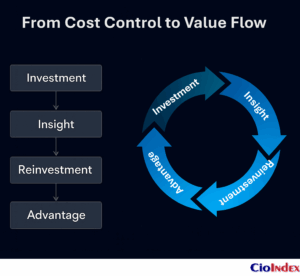

The result is a reckoning across industries. Executives are realizing that the economics of transformation cannot be managed like IT budgets or capital expenditures; they must be governed as dynamic portfolios of learning, risk, and value creation. The most successful organizations share a common discipline: they convert spending into sensemaking — transforming every dollar of investment into insight about what drives impact.

This shift reframes transformation as an act of economic intelligence — understanding not only what is being built but how value flows through technology, people, and processes over time.

From IT Spend to Strategic Investment

Until recently, technology budgets were governed like utilities — stable, predictable, and detached from the logic of growth. IT spending was treated as a cost of doing business rather than a source of competitive advantage. The mandate was reliability, not return. But digital transformation has redrawn this economic logic. What was once a supporting function has become the architecture of value itself.

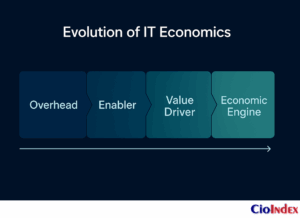

The evolution of technology economics can be traced through four distinct eras:

- IT as Overhead (1990s–2000s):

Enterprises viewed IT as an efficiency utility. Success meant cost containment and uptime. Capital expenditures focused on hardware, licensing, and standardization. The CIO reported to the CFO, and budgets were justified through operational continuity rather than business impact. - IT as Enabler (2010s):

Technology began driving productivity and process optimization. Enterprise systems, analytics, and automation became levers of scale. Yet investments were still episodic — funded as discrete projects with linear payback expectations. Digital was strategic in rhetoric, but financial logic remained transactional. - IT as Value Driver (2020s):

With customer experience, platform ecosystems, and data intelligence at the center of growth, technology shifted from enabler to engine. Competitive advantage increasingly resides in code, data, and connectivity. The balance sheet now reflects this: intangible digital assets — data platforms, proprietary algorithms, customer analytics — constitute a growing share of enterprise value. - IT as Economic Engine (2030 Horizon):

The frontier now emerging treats digital as the very substrate of economic performance. AI, autonomous decisioning, and intelligent platforms will not merely support operations — they will define them. Technology becomes capital metabolism — the flow of adaptive capability that powers every other function.

This progression represents more than a technological evolution; it marks a shift in investment philosophy. Traditional CapEx and OpEx boundaries are dissolving as cloud and platform models recast spending into continuous reinvestment. What was once cyclical has become perpetual — a living portfolio of capabilities that compound over time.

Leading organizations now treat digital infrastructure not as depreciating assets but as appreciating capital. They capitalize data platforms, treat reusable APIs as economic assets, and measure the velocity of reinvestment as a leading indicator of competitiveness. In several sectors — from banking to manufacturing — technology capital expenditure now exceeds physical plant investment, a reversal of industrial-era economics.

The implication is profound: IT is no longer a cost structure; it is the structure of cost. The enterprise balance sheet is being rewritten in code.

The Cost Architecture of Transformation

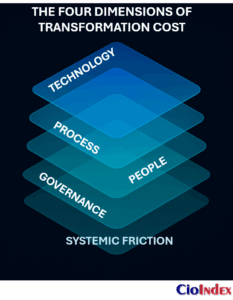

Digital transformation is often described as a strategic imperative, but beneath the strategy lies an intricate cost architecture — one that is rarely visible in its entirety. Transformation spending is not a monolith; it is a network of investments, dependencies, and hidden frictions that collectively determine whether transformation scales or stalls.

Most organizations track technology budgets but overlook the structural costs embedded in people, process, and governance — creating chronic misalignment between what is funded and what truly drives change. To understand why transformation budgets balloon and ROI lags, the economic anatomy must be made explicit.

The Four Economic Dimensions of Transformation

- Technology Infrastructure (30–35%)

The visible dimension: cloud migration, data modernization, integration, and cybersecurity. This is where transformation begins — and where most budgets are anchored. Yet infrastructure spend is only the foundation; it enables transformation but does not complete it. - Process Redesign (20–25%)

The operational dimension: automation, workflow optimization, and service design. These investments redefine how work gets done. Their impact compounds when processes are reimagined rather than digitized in place. - People and Culture (25–30%)

The behavioral dimension: reskilling, leadership alignment, and adoption readiness. These are often underfunded or treated as soft costs, even though cultural friction is one of the largest economic drags in transformation. Independent research shows that allocating 25 percent or more of transformation budgets to change enablement doubles adoption rates. - Change Overhead (15–20%)

The connective dimension: compliance, vendor management, integration governance, and coordination across silos. This is the price of complexity — connecting the new with the old while maintaining momentum across distributed programs.

Beneath these quantifiable domains lies a fifth, less visible stratum: systemic friction — the cost of learning at scale.

Every transformation introduces temporary inefficiencies as systems, teams, and processes adapt. Productivity dips before it recovers. Decision rights shift, governance models evolve, and legacy dependencies resurface. This is not waste; it is the economic learning curve inherent in transformation.

Technical debt amplifies this friction. Outdated systems and architectural inertia absorb disproportionate resources just to maintain stability, crowding out investment in innovation. As explored in The Legacy IT Trap, technical debt converts future potential into current constraint, inflating the cost base and delaying value realization — a hidden interest rate on digital ambition.

CFOs and CIOs share a common blind spot: accounting systems capture expenditure but not capability flow. A $10 million budget line may fund a platform, but without models that trace how value propagates through learning and reuse, transformation economics remain distorted.

Transformation costs rise not because organizations spend too much, but because they learn too slowly. The most mature enterprises treat each cost center as an investment in adaptive capacity — an economic flywheel where spending compounds into capability, and capability compounds into competitive advantage.

Rethinking ROI in the Digital Era

Traditional ROI frameworks were built for an industrial economy — one defined by linear production, discrete investments, and predictable returns. They measure efficiency, not adaptability. Yet digital transformation unfolds in complex systems where advantage is emergent, delayed, and often intangible. The financial models that served machinery and capital projects cannot account for ecosystems, data, or learning curves.

Digital transformation redefines the relationship between cost, time, and impact. A digital capability matures through iteration: each release strengthens the next. The first investment seldom delivers its full return; it lays the foundation for return velocity — the rate at which learning and reuse multiply outcomes over time.

The problem isn’t that ROI is outdated, but that it’s incomplete. Conventional metrics capture output but not capability flow; they track expenditure, not adaptability. They can measure the cost of a platform but not the agility it enables. Organizations often mistake delayed value realization for lack of return.

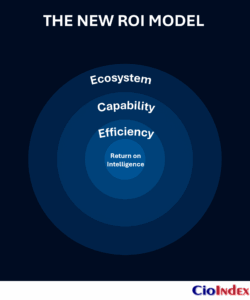

To correct this distortion, ROI must evolve from Return on Investment to Return on Intelligence — a measure of how effectively an enterprise converts data, learning, and collaboration into adaptive advantage.

The Three Horizons of Digital Value

- H1 – Efficiency (Short Term):

Immediate gains in cost, speed, and process reliability. The improvements are tangible but finite. - H2 – Capability (Medium Term):

The compounding phase where data, analytics, and digital fluency enhance decision quality and agility. - H3 – Ecosystem (Long Term):

The systemic horizon where network effects, platforms, and AI-driven learning loops generate continuous returns.

A McKinsey 2024 study found that digital leaders achieve 2.3× higher ROI than laggards — not because they spend less, but because they compound learning faster. Their value systems recycle knowledge: every iteration feeds the next, shortening the lag between investment and impact.

Value leakage occurs when initiatives are isolated — insights trapped in silos, lessons lost between projects. The result is erosion of compounding returns. True maturity lies not in total ROI but in its elasticity — the capacity to sustain and accelerate return through continuous learning.

The new ROI model recognizes three interlocking value streams:

- Tangible: measurable efficiency, cost savings, productivity.

- Intangible: data literacy, innovation capacity, employee empowerment, trust.

- Networked: ecosystem reach, API reuse, and customer feedback loops.

When value becomes systemic, ROI becomes continuous. The goal is not to optimize projects but to design a system in which every investment amplifies the next — a living feedback loop where insight, adaptation, and reinvestment drive enduring advantage.

The CFO–CIO Alliance: A New Economic Partnership

Digital transformation has blurred the boundaries between technology and finance. Where the CIO once delivered systems and the CFO delivered discipline, both now share responsibility for how capital becomes capability. Technology investments are no longer line items to approve but portfolios to steward — living systems that evolve through iteration, risk, and reinvestment. The alliance between finance and technology leaders has become not just strategic but structural: transformation depends on it.

Historically, this relationship was marked by opposing instincts. The CFO pursued certainty — budgets, controls, predictability. The CIO pursued change — innovation, agility, experimentation. Each viewed the other through a different lens of value. As technology has become the enterprise’s largest lever of competitiveness, the separation between fiscal prudence and digital ambition has eroded. Transformation now demands financial imagination and technological discipline in equal measure.

From Budget Oversight to Value Governance

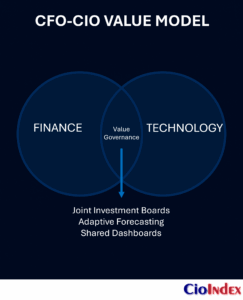

Leading organizations have reframed how finance and IT collaborate. Rather than negotiating budgets annually, CFOs and CIOs now govern transformation through shared economic logic — a continuous dialogue of learning, risk, and return. Three mechanisms define this modern partnership:

- Joint Investment Boards:

Cross-functional committees where finance, technology, and business leaders evaluate digital initiatives as a balanced portfolio — optimizing for strategic value, not just cost control. - Scenario-Based Forecasting:

Instead of static business cases, investments are modeled as adaptive options with learning milestones. Funding can expand or contract as evidence accumulates, linking fiscal agility to transformation velocity. - Integrated Dashboards:

Shared visibility into value flow — combining financial metrics (spend, depreciation, ROI) with operational ones (adoption, uptime, innovation velocity). These dashboards replace audit snapshots with real-time sensing.

In this model, the CFO becomes a value architect, translating transformation outcomes into financial language the enterprise understands. The CIO becomes a capital strategist, ensuring technology roadmaps express measurable value creation. Their partnership turns finance into an enabler of experimentation, not its constraint.

Case studies illustrate the shift. At DBS Bank, joint funding committees ensure digital initiatives are treated as enterprise investments, not departmental projects — allowing reallocation of capital based on adoption and performance. At Unilever, digital finance frameworks embed ROI elasticity measures directly into program reviews, tying reinvestment to demonstrated learning. In both cases, the CFO–CIO partnership acts as the enterprise’s “economic nerve system,” linking money flow to value flow.

A New Language of Investment

This partnership also introduces a new vocabulary into executive governance:

- From budget requests to value hypotheses.

- From projects to products.

- From approvals to adaptive funding cycles.

Transformation maturity depends on how fluently leadership speaks this new language. The CFO brings the grammar of capital discipline; the CIO brings the syntax of learning systems. Together they create a shared semantics of value — one that allows the enterprise to sense, fund, and scale transformation continuously.

The real innovation, then, is not in technology but in how organizations decide. When finance and technology leaders co-author economic intelligence, transformation ceases to be an expense and becomes a renewable source of advantage.

Funding Models for the Digital Enterprise

Traditional funding systems were designed for predictability. They assumed that technology initiatives followed linear plans, stable scope, and fixed endpoints — assumptions incompatible with the perpetual nature of digital transformation. When transformation is continuous, funding must be fluid, evidence-based, and capable of learning. The challenge is not how to budget transformation, but how to continuously capitalize adaptation.

From Projects to Portfolios

Legacy frameworks remain project-based: finite timelines, isolated deliverables, and business cases built on hypothetical ROI. This rigidity forces initiatives to compete for capital rather than compound it. When capital runs out, learning halts and momentum resets.

Leading enterprises are replacing this approach with portfolio-oriented investment, dynamically allocating capital across evolving products, platforms, and capabilities. Here, money follows outcomes, not milestones. The focus shifts from cost justification to value-realization velocity — the rate at which investments yield adoption, insight, or market impact.

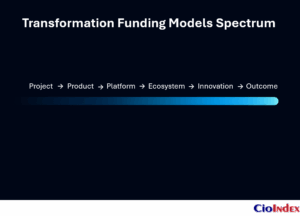

The Six Emerging Investment Approaches

- Project-Based (Legacy):

Traditional, milestone-driven, approval-heavy. Effective for fixed-scope work such as infrastructure upgrades but too rigid for iterative change. - Product-Based:

Empowers persistent teams to own outcomes. Budgets align with product lifecycles rather than deadlines, fostering continuity and accountability. - Platform Capitalization:

Treats shared digital foundations — cloud, data, AI — as appreciating assets. Returns compound as other initiatives reuse and extend them. - Ecosystem Co-Funding:

Pools resources across business units or partners to build shared capabilities, from data exchanges to industry platforms. - Innovation Capital Pools:

Venture-style allocations for experimentation, managed through stage-gates or outcome checkpoints. Failure becomes research, not waste. - Outcome-Linked Funding:

Releases capital based on verified results — adoption rates, efficiency gains, customer impact — reinforcing accountability and learning.

Each approach carries distinct implications for governance and risk. The most resilient enterprises blend them — anchoring stability where it preserves trust and applying flexibility where it accelerates innovation. Diversity of capital strategy becomes a hedge against uncertainty.

From Fixed Budgets to Responsive Capital

Cloud economics have accelerated this shift. By converting capital expenditure into operating expenditure, organizations gain flexibility but sacrifice predictability. The trade-off is agility for certainty — and managing that balance has become a strategic skill. CFOs and CIOs now design hybrid portfolios where infrastructure scales elastically while innovation funding remains protected.

Many have adopted rolling-wave budgeting, adjusting allocations quarterly based on evidence and learning velocity. Others use value-stream funding, aligning capital to customer journeys rather than departments. Both synchronize money flow with learning flow, mirroring the adaptive rhythm of agile delivery.

The financial language of transformation is changing. Where once funding meant approval, it now signifies renewal — an ongoing commitment to learn, adjust, and reinvest. The goal is not to predict every outcome but to build an investment system that senses when to accelerate, pause, or pivot.

As transformation becomes continuous, so must its economics. Enterprises that master responsive funding systems are not merely financing change — they are engineering resilience.

Measuring Economic Maturity: From Spend to Value

Most enterprises still measure activity, not advantage — how much they spend, not how effectively that spend evolves into impact. In digital transformation, maturity is not defined by the size of the budget but by the precision with which outcomes are understood, measured, and reinvested.

The Shift from Cost Accounting to Value Intelligence

Traditional accounting delivers control, but not comprehension. It captures what was spent but not what was learned. It explains cost but not capability. Modern transformation demands value intelligence — the ability to trace how capital flows through systems, teams, and platforms, creating both immediate performance and future potential.

Economic maturity, therefore, reflects four interdependent capabilities: visibility, traceability, agility, and sustainability — the levers that determine whether an organization’s transformation economics are reactive or regenerative.

The Four Dimensions of Economic Maturity

- Spend Visibility

The foundational stage. Organizations gain a consolidated view of where digital investment resides across functions, vendors, and programs — exposing duplication, shadow budgets, and misalignment. - Value Traceability

The connective stage. Investments are linked to measurable outcomes — adoption, efficiency, customer experience — creating a clear line of sight from spend to impact. - Capital Agility

The adaptive stage. Allocation becomes dynamic, adjusting as data and learning evolve. Budgets expand or contract based on evidence, not inertia. - Sustainability of Returns

The strategic stage. Enterprises sustain and compound benefits beyond project horizons through reuse, talent development, and reinvestment. Transformation becomes self-funding.

Each stage builds on the previous one, forming an upward curve from financial transparency to economic intelligence.

Economic Archetypes: How Maturity Manifests

| Archetype | Characteristics | Economic Signature |

|---|---|---|

| Traditionalists | Fragmented reporting, cost-centric KPIs, limited ROI visibility. | Spend ≠ Impact. |

| Integrators | Partial linkage between spend and results; funding remains project-based. | Value captured inconsistently. |

| Value Architects | CFO–CIO alignment, integrated dashboards, agile reallocation. | Value tracked and scaled. |

| Adaptive Enterprises | Continuous reinvestment and feedback-driven budgeting. | Value compounds autonomously. |

Metrics That Matter

A mature organization measures how fast capital learns. Key indicators include:

- Capital agility ratio: percentage of spend reallocated within a fiscal year based on learning.

- Time-to-value: duration from investment to measurable impact.

- Reinvestment velocity: share of realized savings redirected into innovation.

- Adoption elasticity: how quickly new capabilities reach sustained usage.

These indicators provide a multidimensional view of performance — not just what was achieved, but how economically the enterprise learned to achieve it.

From Measurement to Mastery

Maturity is not a certification; it is a feedback system. The most advanced organizations use maturity models not as audits but as mirrors — reflecting how their decisions reinforce or constrain transformation. They measure to improve judgment, not to justify expenditure.

In this sense, measurement becomes an act of strategy — a way of sensing how well the enterprise converts capital into capability, and capability into continuity.

The higher the maturity, the shorter the distance between spend, sense, and scale.

Case Insight: When Economics Drive Transformation

The economics of transformation come alive not in theory but in the choices organizations make under constraint — when ambition, cost, and risk collide. The following two cases show how economic logic transforms digital initiatives from expenditure to advantage.

Case 1: Manufacturing — Turning Product Funding into a Value Engine

A global manufacturer faced a common dilemma: rising digital spend with diminishing returns. Each business unit ran its own modernization effort, producing duplicated platforms, inconsistent data, and escalating integration costs. Annual budgets reinforced the problem — project-based funding rewarded completion, not continuity.

In 2021, the company replaced this model with product-based funding. Persistent, cross-functional teams were established around core digital products — data platforms, supply-chain visibility, predictive maintenance, and customer analytics — funded through ongoing capital allocations rather than temporary budgets.

The CFO and CIO introduced a joint portfolio review cadence, evaluating digital products on adoption, reuse, and contribution to business outcomes. Underperforming initiatives were paused; high-performing ones were reinvested. Within two years, redundant programs dropped by 35%, while time-to-value for new capabilities nearly halved.

The shift was not only structural but cultural. Finance began to see technology as a compounding asset. Business units started to view funding as a mechanism for progress, not permission. The company’s digital platform now sustains itself: efficiencies generated today fund tomorrow’s innovation.

Case 2: Public Sector — From Cost Control to Capability Reuse

A national public-service agency launched a multi-year modernization program to digitize citizen services. Initially, its funding approach mirrored a classic project model: discrete annual budgets and rigid renewals. Progress was slow, and costs rose sharply. Auditors found that over 40 percent of annual digital investment went toward rework and integration rather than new capability.

Following an internal review, the agency restructured its approach around outcome-based financing. Budgets were released in tranches tied to adoption milestones — citizen uptake, processing speed, and satisfaction scores. A shared value dashboard gave finance and technology leaders real-time visibility into progress.

Within 18 months, reuse of shared components across departments rose from 10% to 60%. The cost per digital service request fell by 25%. Most importantly, governance shifted from compliance to continuous improvement — each cycle began where the last one ended, not from zero.

The agency’s success was not technical but economic. It proved that even in rigid, scrutinized environments, adaptive financing can align accountability with progress.

Pattern Recognition: The Economics of Success

Across both cases, three lessons define how economic maturity behaves in practice:

- Funding as Feedback:

Investment decisions evolve continuously, guided by performance rather than static approval. - Capital as Catalyst:

Money accelerates learning and reuse, converting insight into durable capability. - Value as Continuum:

Transformation ceases to have a finish line — it becomes a compounding system of reinvestment.

When governance and funding structures learn as quickly as the technologies they finance, transformation moves from project to perpetuity.

Implications for CIOs and Boards: Governing the Economics of Transformation

Digital transformation has become a board-level economy — every strategic decision now carries a capital signature. The question is no longer how much to spend but how intelligently to invest. CIOs and Boards sit at the fulcrum of this reality, where governance is not approval but adaptation, and oversight must evolve into economic sensemaking.

From Oversight to Orchestration

Boards once governed technology from a distance, treating it as a cost center to monitor rather than a system to steer. That separation is no longer tenable. Transformation decisions now define enterprise value, risk exposure, and competitive agility — the very levers of stewardship itself.

Mature Boards are shifting from compliance-oriented oversight to strategic orchestration: setting principles for how capital, capability, and culture interact.

This requires fluency in three questions that shape transformation economics:

- How does technology investment compound over time?

- What mechanisms ensure that learning is reinvested, not lost?

- How do we know whether transformation is creating structural advantage or just digital noise?

The answers form the foundation of economic governance — where financial discipline and digital intelligence converge.

The CIO as Economic Architect

The modern CIO is no longer a systems custodian but the architect of the enterprise’s economic metabolism — the interconnected flow of capital, data, and capability. Every technology choice now defines cost velocity, data liquidity, and decision speed. The CIO’s role extends beyond delivery to economic architecture — designing platforms and governance models that translate investment into adaptive capacity.

This demands fluency in financial constructs — ROI elasticity, capital agility, time-to-value — and the ability to express technology strategy in the grammar of enterprise economics. The CIO becomes the translator between innovation and investment, ensuring that every experiment carries measurable logic and return.

Boards increasingly expect this literacy. According to a 2025 Gartner Board Governance Survey, over 70% of directors now evaluate CIO performance through business outcomes and capital productivity, not system uptime. The CIO’s success is measured not by operational efficiency but by economic impact.

The Board’s Role in Economic Stewardship

Boards succeed not by mastering technology but by institutionalizing learning. Transformation economics thrive when decision-makers institutionalize adaptive principles — approving investment frameworks rather than isolated projects.

Progressive Boards establish economic guardrails that define how much risk, reinvestment, and experimentation are acceptable. Many now conduct digital capital reviews within quarterly governance cycles, assessing both financial and non-financial indicators — capability reuse, time-to-value, and reinvestment velocity.

This shift from reporting to economic sensing turns governance into an active learning system — one that maintains both discipline and adaptability.

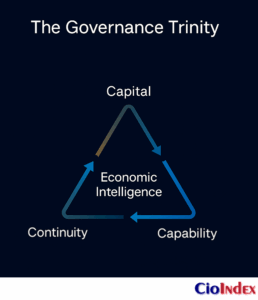

The Governance Trinity: Capital, Capability, Continuity

Transformation governance rests on three interdependent pillars:

| Pillar | Description | Board Imperative |

|---|---|---|

| Capital | Funding mechanisms that adjust to evidence and learning velocity. | Move from annual budgets to responsive capital portfolios. |

| Capability | Systems, talent, and processes that convert investment into agility. | Ensure workforce, data, and architecture maturity match spending pace. |

| Continuity | Mechanisms that sustain reinvestment and reuse beyond projects. | Institutionalize learning to compound long-term advantage. |

When Boards align these three pillars, transformation economics become self-reinforcing — a cycle of informed risk-taking and continuous return.

From Digital Transformation to Economic Intelligence

The next frontier of governance is not digital transformation but economic intelligence — the institutional ability to sense, interpret, and adapt financial and technological signals in real time. CIOs and Boards who master this discipline turn transformation into a feedback system — where capital evolves with learning, and learning becomes capital in its own right.

The maturity of an enterprise is measured not by how much it transforms, but by how intelligently it reinvests.

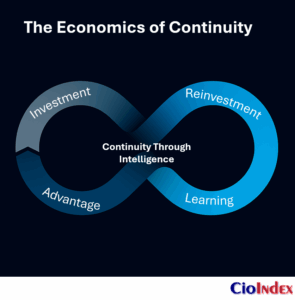

The Economics of Continuity

Transformation once signified disruption. Now it signifies endurance. The enterprises that endure are not those that invest the most, but those that learn the fastest — converting every expenditure, experiment, and insight into a compounding cycle of advantage. The true economics of transformation are, at their core, the economics of continuity.

Across this exploration, transformation has emerged not as a technology program or budget initiative, but as a living economic system — one that learns, adapts, and reinvests. From the paradox of digital value to the governance trinity of capital, capability, and continuity, the lesson is clear: digital advantage is sustained only when financial logic and learning logic move as one.

For CIOs and Boards, this convergence redefines leadership. Technology no longer underpins the enterprise; it animates it. Finance no longer records performance; it shapes it. Governance, once a mechanism of control, becomes an act of economic intelligence — the ability to sense where capital creates capability, and where capability sustains growth.

Maturity, in this new landscape, is not measured by transformation completed but by transformation sustained — by how effectively the enterprise reinvests what it learns. Resilience replaces return as the ultimate measure of value.

The future will not reward those who transform once, but those who transform continuously. Every investment must deepen insight. Every insight must refine judgment. Every cycle must build capacity to renew.

Transformation is no longer the pursuit of change — it is the mastery of renewal.